Bullish Gap Down Reversals – A Guide to Trading Strategy

Identifying profitable trading opportunities in the stock market can be a challenging task. Traders often rely on technical analysis and chart patterns to make informed decisions about when to buy or sell a particular stock. One strategy that has gained popularity among traders is the bullish gap down reversal pattern. This pattern occurs when a stock opens lower than its previous day’s close but then reverses direction and closes higher for the day.

To effectively profit from bullish gap down reversals, traders must first understand the psychology behind this pattern. When a stock gaps down at the open, it often triggers panic selling among investors who fear further price declines. However, as the day progresses, some traders may see the lower price as an attractive buying opportunity, leading to a surge in buying pressure that drives the stock higher.

To successfully trade bullish gap down reversals, traders should use technical indicators and chart patterns to confirm the strength of the reversal. One common strategy is to wait for a bullish candlestick pattern, such as a hammer or engulfing pattern, to form after the initial gap down. These patterns signal a shift in sentiment from bearish to bullish and can provide a reliable entry point for traders looking to profit from the reversal.

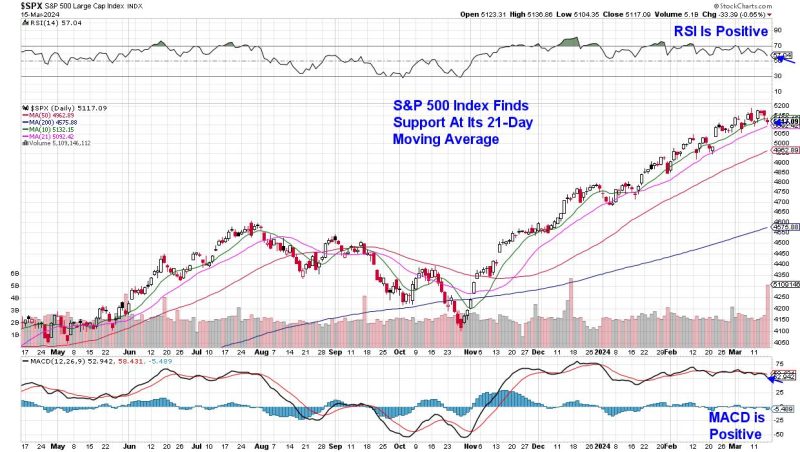

In addition to candlestick patterns, traders can use other technical indicators, such as moving averages and volume analysis, to confirm the strength of the reversal. For example, a sharp increase in trading volume following the gap down can indicate strong buying pressure and support the likelihood of a bullish reversal.

Risk management is also essential when trading bullish gap down reversals. Traders should set stop-loss orders to limit potential losses in case the trade does not go as expected. By defining their risk tolerance and using proper risk management techniques, traders can protect their capital and maximize their potential returns when trading this pattern.

Overall, trading bullish gap down reversals can be a profitable strategy for traders who are able to accurately identify and capitalize on these opportunities. By understanding the psychological dynamics behind this pattern, using technical indicators to confirm the reversal, and implementing proper risk management techniques, traders can increase their chances of success when trading this pattern in the stock market.