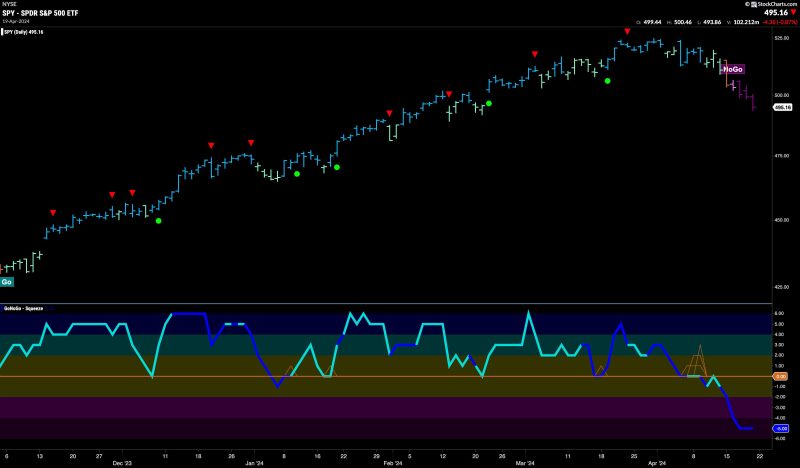

Equities Struggle in Strong No-Go as Materials Try to Curb the Damage

The recent market landscape has been tumultuous, with equities facing challenges in the face of a strong no-go sentiment. Investors and traders alike are navigating a complex environment characterized by uncertainty and volatility. Against this backdrop, materials sector stocks have emerged as key players striving to mitigate the damage and provide some stability to the broader market.

One of the primary factors contributing to the struggle of equities in this challenging environment is the prevailing no-go sentiment among investors. This sentiment reflects a cautious approach towards taking risks and making investment decisions in the current market conditions. The uncertainty stemming from factors such as geopolitical tensions, economic indicators, and global trade dynamics has led to a risk-averse attitude among market participants. As a result, equities have faced headwinds as investors opt for safer assets or seek shelter in defensive sectors.

Amidst this climate of caution and uncertainty, the materials sector has emerged as a focal point for investors looking to curb the damage and find some stability in their portfolios. The materials sector encompasses companies involved in the extraction, processing, and production of raw materials such as metals, chemicals, and construction materials. These companies play a vital role in various industries, ranging from manufacturing and construction to technology and energy.

Despite the overall challenges facing equities, materials sector stocks have shown resilience and provided some support to the broader market. The demand for raw materials remains relatively stable, driven by ongoing infrastructure projects, urbanization trends, and industrial activities. Companies in the materials sector have been able to capitalize on these opportunities and deliver solid financial performances, which have helped offset some of the negative impacts on equities from other sectors.

Moreover, the materials sector has benefited from certain tailwinds that have bolstered its performance in the face of broader market headwinds. Factors such as rising commodity prices, supply chain disruptions, and global economic recovery efforts have created favorable conditions for materials companies to thrive. In addition, the focus on sustainability and ESG (Environmental, Social, and Governance) principles has incentivized investments in companies that demonstrate responsible practices in material sourcing, production, and waste management.

As equities continue to navigate through the challenges posed by the strong no-go sentiment, the materials sector stands out as a key player in curbing the damage and providing a semblance of stability to the market. Investors looking to diversify their portfolios and mitigate risks may find opportunities in materials sector stocks, which offer exposure to essential industries and sustainable growth prospects. By understanding the dynamics at play in the materials sector and monitoring key trends and developments, investors can make informed decisions to navigate the current market environment successfully.