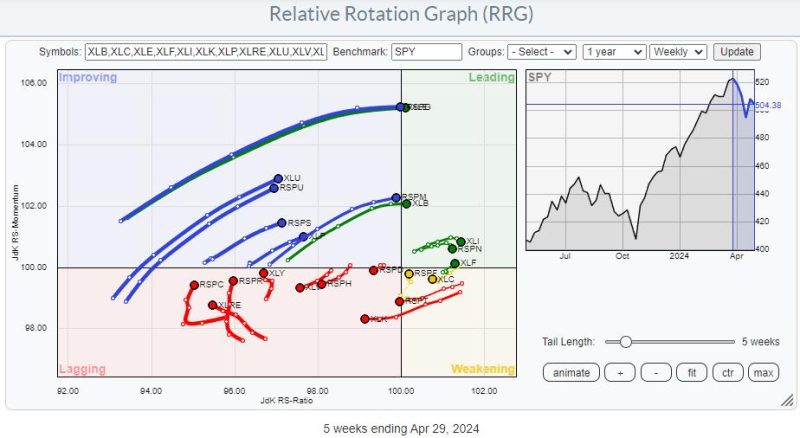

In the world of trading and investing, keeping a close eye on market trends and analyzing various asset classes is crucial for making informed decisions. Relative Rotation Graphs (RRGs) have emerged as a popular tool among traders and investors for visualizing the relative strength of multiple assets against a common benchmark. By plotting the rotational movements of assets on a chart, RRGs offer valuable insights into potential trading opportunities.

The RRG displayed in the reference link reveals diverging tails and presents interesting trading prospects. Let’s delve deeper into the interpretation of these divergences and how they can be utilized to optimize trading strategies.

Diverging tails on an RRG indicate that two or more assets are moving in different directions relative to the benchmark. In the context of trading, this divergence signifies a potential shift in market dynamics and relative performance. Assets with a leading (strong) or weakening (weak) tail are particularly important to focus on, as they signify significant momentum in either direction.

When analyzing diverging tails on an RRG, traders can capitalize on the following trading opportunities:

1. **Relative Strength**: Assets with a leading tail are exhibiting strong relative strength compared to the benchmark. These assets are likely to outperform in the near term and present buying opportunities. By focusing on assets with strong momentum and positive price action, traders can ride the trend and capture potential profits.

2. **Relative Weakness**: On the other hand, assets with a weakening tail are underperforming relative to the benchmark. These assets may present short-selling opportunities or serve as a signal to exit existing long positions. Traders can consider taking a contrarian stance and look for opportunities to profit from the downward movement in these assets.

3. **Sector Rotation**: Diverging tails on an RRG can also reveal sector rotation trends, where capital flows from one sector to another based on changing market dynamics. By identifying sectors with leading tails and strong momentum, traders can allocate their capital strategically to sectors poised for growth and capitalize on shifting market trends.

4. **Risk Management**: Understanding diverging tails on an RRG is essential for effective risk management. Traders can use this information to adjust their positions, set stop-loss levels, and protect their capital during periods of market uncertainty. By actively monitoring diverging tails and adjusting trading strategies accordingly, traders can mitigate risks and optimize returns.

In conclusion, diverging tails on an RRG unveil valuable trading opportunities for traders and investors. By analyzing the rotational movements of assets and interpreting the relative strength and weakness displayed on the chart, traders can make informed decisions and optimize their trading strategies. Keeping a close watch on diverging tails and adapting to changing market conditions is key to succeeding in the dynamic world of trading and investing.