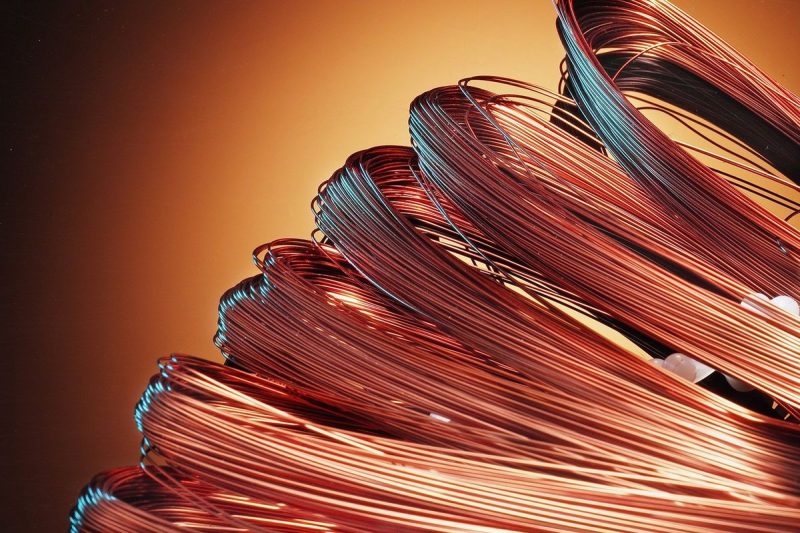

In the world of investing, copper has always held a significant place due to its versatile applications across various industries. As a crucial industrial metal, copper plays a vital role in sectors such as construction, electronics, and transportation. Investors seeking exposure to copper often turn to exchange-traded funds (ETFs) and exchange-traded notes (ETNs) as a convenient way to invest in this commodity without the need for direct ownership. Here, we will explore six copper ETFs and ETNs that can offer investors opportunities to participate in the potential growth of the copper market.

1. **United States Copper Index Fund (CPER)**: CPER is designed to reflect the performance of copper and provides exposure to the futures price of copper. This ETF is structured as a grantor trust and may be a suitable option for investors looking for direct exposure to copper prices.

2. **Global X Copper Miners ETF (COPX)**: COPX focuses on companies involved in the extraction and production of copper. By investing in copper mining companies, investors can gain exposure to both the price of copper and the profitability of copper production.

3. **Barclays iPath Series B Bloomberg Copper Subindex Total Return ETN (JJCB)**: JJCB is an exchange-traded note that offers exposure to the performance of the copper market through futures contracts. This ETN may be suitable for investors seeking short-term exposure to copper prices.

4. **Teucrium Copper (COPX)**: COPX is a unique copper ETF that aims to reflect the changes in the price of copper delivered to locations in the U.S. This ETF’s investment strategy involves investing in a range of futures contracts on copper.

5. **United States 12 Month Copper Index Fund (CPER)**: CPER provides exposure to copper prices through a portfolio of copper futures contracts. This ETF is structured as a grantor trust and seeks to track the performance of copper prices over a 12-month period.

6. **Element30 Copper Efficiency ETF (JJC)**: JJC focuses on companies that are involved in advancing copper efficiency in various industries. This ETF provides exposure to companies that are innovating and driving advancements in the use of copper, offering a unique way to invest in the copper market.

In conclusion, investing in copper ETFs and ETNs can be a strategic way for investors to gain exposure to the copper market without the need for direct ownership of physical copper. These investment vehicles offer various ways to participate in the potential growth and profitability of the copper industry. Before investing in any of the mentioned ETFs or ETNs, it is essential for investors to conduct thorough research, assess their risk tolerance, and consider consulting with a financial advisor to ensure the appropriateness of these investments in their overall portfolio.