In today’s fast-paced and ever-evolving financial landscape, a sound and systematic approach to money management is crucial for investors seeking to make informed decisions and minimize risks. Adopting a rules-based strategy can provide structure and discipline to investment decisions, helping to remove emotions from the equation and increase the potential for consistent returns.

One key aspect of rules-based money management is the use of security ranking measures to assess the quality and attractiveness of potential investments. By incorporating objective criteria and quantifiable metrics, investors can effectively evaluate securities and allocate capital in a strategic manner. In this article, we will explore some common security ranking measures used in rules-based money management and their importance in the investment process.

1. Fundamental Analysis: Fundamental analysis is a cornerstone of security ranking measures, focusing on the intrinsic value of a security based on factors such as earnings, revenue, growth prospects, and competitive positioning. By conducting a thorough analysis of a company’s financial health and performance metrics, investors can gain insights into its potential for future growth and profitability. Fundamental analysis helps investors identify undervalued or overvalued securities and make informed decisions based on underlying fundamentals.

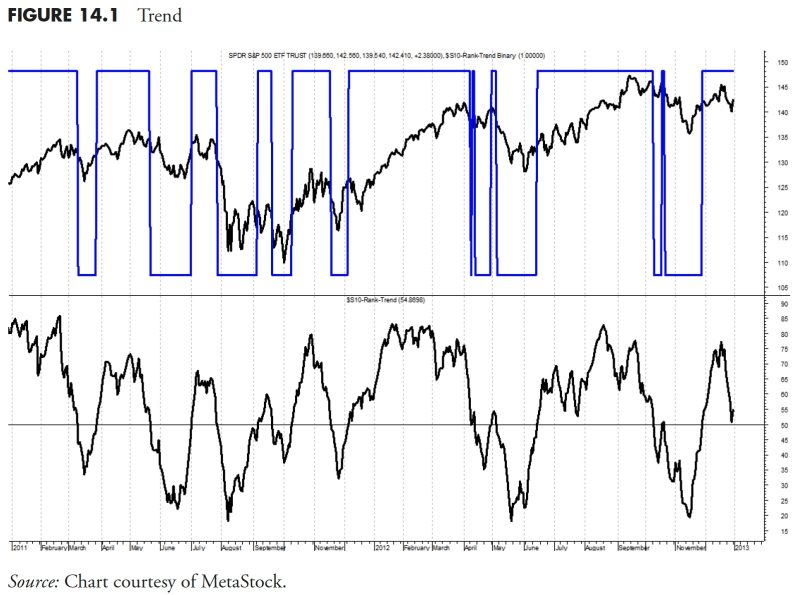

2. Technical Analysis: Technical analysis involves the study of past market data, such as price movements and trading volume, to forecast future price movements. By applying technical indicators and chart patterns, investors can identify trends, momentum, and potential entry or exit points for securities. Technical analysis complements fundamental analysis by providing valuable insights into market sentiment and investor behavior, helping investors gauge the timing of their trades and optimize their risk-to-reward ratio.

3. Risk Management Metrics: Risk management is an integral part of rules-based money management, aimed at preserving capital and managing downside risk. Security ranking measures include metrics such as volatility, beta, maximum drawdown, and Sharpe ratio, which help investors assess the risk-return profile of securities and portfolios. By incorporating risk management metrics into their investment process, investors can establish appropriate risk tolerance levels, set stop-loss orders, and diversify their portfolios to protect against market fluctuations and unexpected events.

4. Relative Strength Analysis: Relative strength analysis compares the performance of a security against a benchmark index or peer group over a specified period. By evaluating the relative strength of securities, investors can identify outperforming or underperforming assets and make strategic allocation decisions. Relative strength analysis helps investors capitalize on trends and momentum in the market, enabling them to position their portfolios for optimal performance.

5. Sentiment Indicators: Sentiment indicators gauge market sentiment and investor psychology, providing insights into the prevailing mood and potential shifts in market sentiment. By monitoring sentiment indicators such as investor surveys, put-call ratios, and social media sentiment, investors can assess market sentiment and adjust their investment strategies accordingly. Sentiment indicators complement fundamental and technical analysis by offering a holistic view of market dynamics and investor behavior.

In conclusion, security ranking measures play a crucial role in rules-based money management by providing objective criteria and analytical tools to evaluate securities and make informed investment decisions. By combining fundamental analysis, technical analysis, risk management metrics, relative strength analysis, and sentiment indicators, investors can enhance their decision-making process and improve the performance of their portfolios. As the financial markets continue to evolve, adopting a rules-based approach to money management can help investors navigate market uncertainty and achieve their investment objectives.