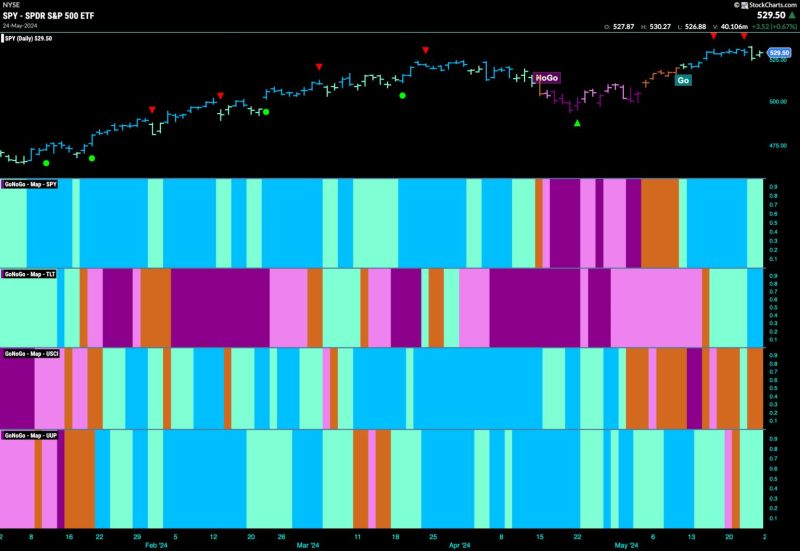

Equities Remain in Go Trend with Sparse Leadership from Tech and Utilities

In the world of investing, the recent trends in equities have continued to showcase momentum, with sparse leadership from the technology and utilities sectors. This dynamic shift in the equity market landscape has raised eyebrows and generated discussions among investors and analysts alike.

The traditional go trend in equities has been reignited with a renewed vigor in recent months. This resurgence has been driven by a combination of factors, including positive economic indicators, robust corporate earnings, and supportive monetary policies. As a result, equities have continued to attract capital inflows from investors seeking higher returns in a low-interest-rate environment.

One notable aspect of this go trend is the limited leadership coming from the technology and utilities sectors. Historically, these sectors have been pivotal in driving equity market performance, given their innovative technologies and stable dividend yields, respectively. However, in the current market environment, other sectors have taken the lead, shifting the focus away from these traditional stalwarts.

The technology sector, which has been a major driver of equity market gains in recent years, has faced headwinds due to concerns around regulatory scrutiny, valuation multiples, and global supply chain disruptions. As a result, investors have diversified their portfolios to include other sectors that offer more attractive valuations and growth prospects.

Similarly, the utilities sector, known for its defensive characteristics and income-generating capabilities, has also played a subdued role in the current equity market rally. The sector’s performance has been hindered by rising interest rates, inflationary pressures, and evolving energy policies, which have dampened investor sentiment towards traditional utility stocks.

In contrast, other sectors such as healthcare, consumer discretionary, and financials have emerged as new leaders in the equity market, driving momentum and outperforming their peers. These sectors have benefited from favorable industry dynamics, improving consumer confidence, and strong earnings growth, which have positioned them as attractive investment opportunities in the current market environment.

This shift in sector leadership underscores the dynamic nature of the equity market and highlights the importance of diversification and active portfolio management. As investors navigate through evolving market conditions, it becomes essential to adapt investment strategies and explore opportunities beyond traditional sector preferences.

In conclusion, while equities remain in a go trend, the leadership landscape has evolved with sparse contributions from the technology and utilities sectors. Investors must remain vigilant, stay informed about market dynamics, and seek diversification across sectors to capitalize on emerging opportunities and navigate potential risks effectively.