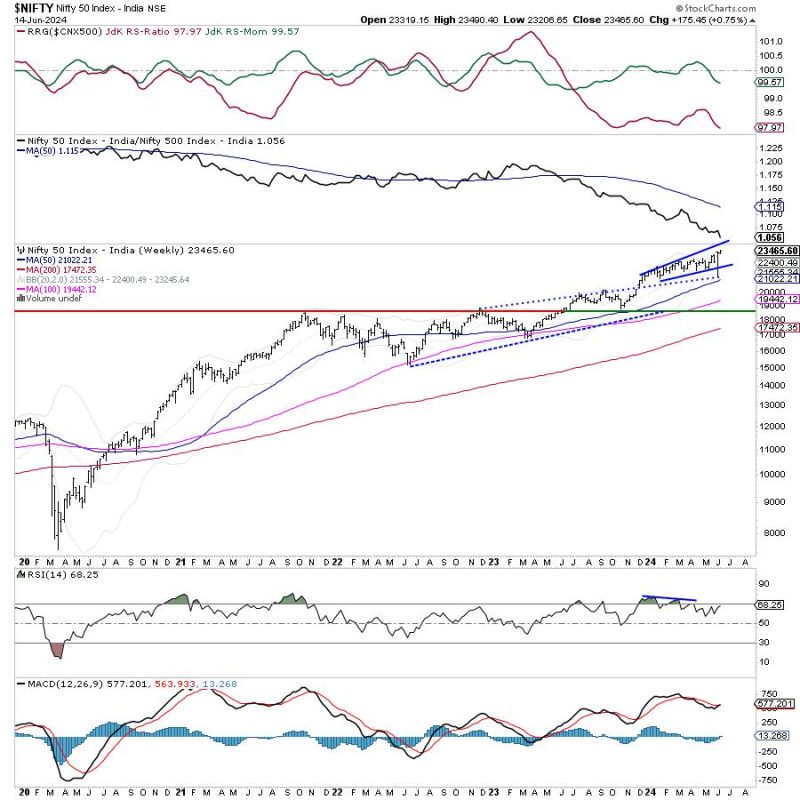

The Week Ahead: Nifty May Stay Tentative, Look for Stocks with Strong Relative Strength

Further Analysis:

Looking ahead at the market trends, it is evident that the Nifty may maintain its tentative stance in the upcoming week. As investors navigate through the uncertainties brought about by various economic factors, it becomes crucial to identify and focus on stocks with strong relative strength. This proactive approach can help in mitigating risks and capitalizing on potential opportunities in the market.

One of the key strategies to adopt in such a scenario is to carry out a thorough analysis of individual stocks based on their relative strength compared to the broader market. By identifying stocks that exhibit strong relative strength, investors can gain insights into the underlying market dynamics and make informed decisions regarding their investment portfolios.

Moreover, monitoring market trends, news developments, and macroeconomic indicators can provide additional context to the relative strength of individual stocks. This holistic approach can help investors in identifying potential outliers that may outperform or underperform the market trends.

In addition to analyzing relative strength, it is essential to consider other factors such as company fundamentals, industry trends, and technical indicators to make well-rounded investment decisions. By integrating a multi-faceted approach to stock selection, investors can build a robust investment portfolio that is well-positioned to weather market fluctuations and deliver strong returns over the long term.

Overall, as the Nifty continues to display a tentative outlook, investors should prioritize stocks with strong relative strength and conduct comprehensive research to identify investment opportunities that align with their risk tolerance and investment objectives. By staying vigilant and adapting to changing market conditions, investors can navigate through the uncertainties and achieve their financial goals.