The recent surge in the S&P 500 index to new record highs has investors questioning whether this trend is fueled by value or growth factors. The debate between value and growth investing has been an ongoing topic in the investment community, each with its strengths and weaknesses. Let’s delve deeper into this discussion to gain a better understanding of the forces driving the market.

Value investing traditionally focuses on companies that are undervalued in the market. Investors believe that the stock price of these companies does not reflect their true intrinsic value, presenting an opportunity for significant future gains. Value investors typically look for stocks with low price-to-earnings (P/E) ratios, high dividend yields, or other metrics that suggest the stock is trading below its fair value.

On the other hand, growth investing emphasizes companies that have the potential for above-average earnings growth. These companies are often at the forefront of innovation and expansion, leading to rapid revenue and profit growth. Growth investors are willing to pay a premium for these stocks in anticipation of strong performance in the future.

In the current market environment, it appears that value factors are driving the surge in the S&P 500 index to new highs. Companies that were previously undervalued are now being recognized for their true worth, leading to substantial price appreciation. Investors are increasingly focusing on fundamental metrics such as earnings, cash flow, and book value, which are characteristic of value investing strategies.

One significant factor contributing to the rise of value stocks is the economic recovery following the pandemic-induced slump. As the economy reopens and business activity resumes, value stocks in sectors such as financials, energy, and industrials are benefiting from the uptick in demand and improved outlook. These sectors were previously undervalued due to the uncertainties surrounding the pandemic but are now gaining traction as economic conditions improve.

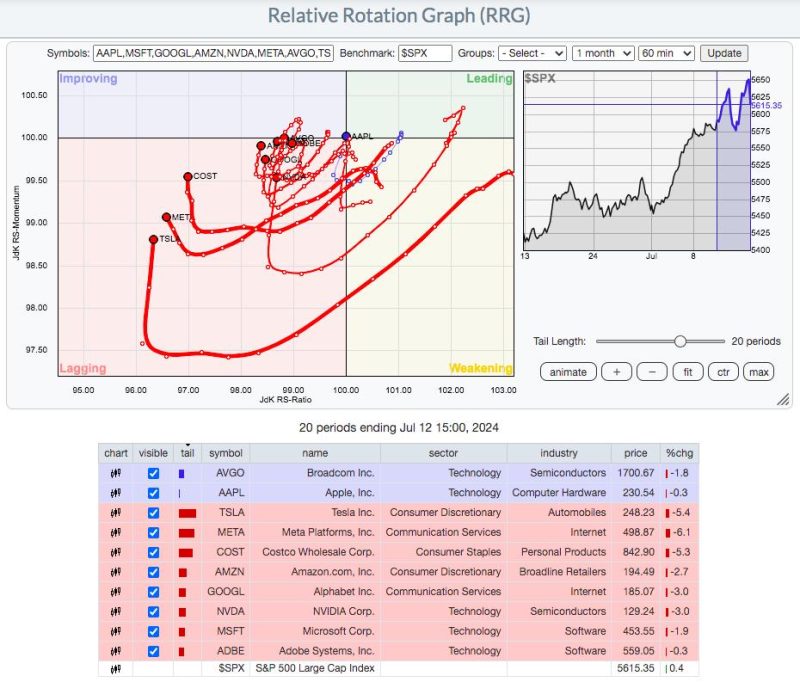

Additionally, the rotation from growth to value stocks is also fueling the rally in the S&P 500 index. After a prolonged period of outperformance by growth stocks, investors are reallocating their portfolios towards value stocks in search of better returns. This shift in investor sentiment is contributing to the overall strength of the value segment in the market.

While value factors may be dominating the current market landscape, it is essential to note that growth stocks still play a crucial role in driving the overall performance of the S&P 500 index. Companies with strong growth potential, especially in sectors like technology and healthcare, continue to attract investor interest and contribute to the market’s upward trajectory.

In conclusion, the recent record highs in the S&P 500 index are primarily driven by value factors, as investors reevaluate undervalued companies in light of the economic recovery. While growth stocks remain relevant in the market, the resurgence of value investing strategies is shaping the current market dynamics. As investors navigate these opposing forces, a balanced approach that incorporates both value and growth principles may offer the best prospects for long-term investment success.