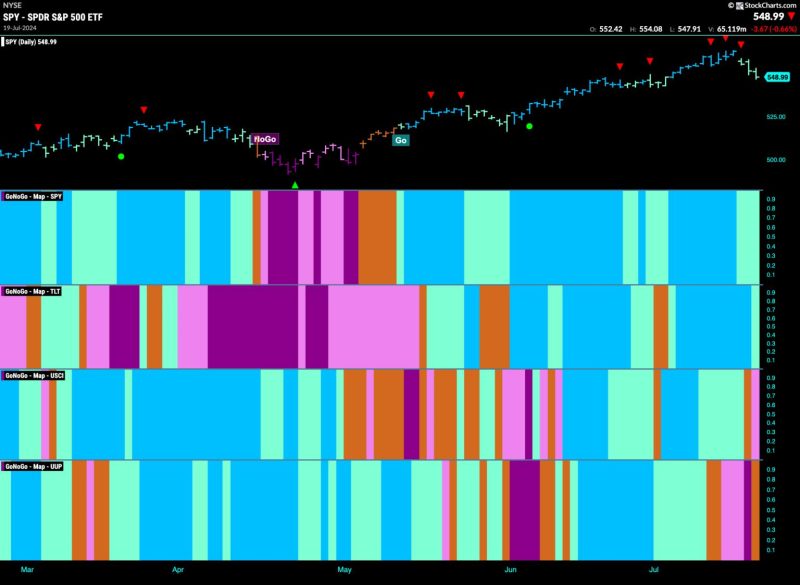

In recent times, there has been a noticeable shift in the financial landscape as equity performance begins to show signs of weakening. This shift is indicative of a broader trend that is emerging within the financial markets, with implications for investors and analysts alike.

One key factor contributing to the weakening trend in equity performance is the changing dynamics of global markets. As geopolitical tensions rise and trade uncertainties persist, investors are becoming increasingly cautious in their approach to equities. This caution has been reflected in the form of reduced investments in traditional equity assets, as investors seek out alternative avenues for growth and stability.

Conversely, the realm of financials has seen a resurgence in performance, with many companies within this sector outperforming expectations. This heightened performance can be attributed to several factors, including increased demand for financial services, advancements in technology, and greater regulatory clarity. As a result, financial companies are finding new opportunities for growth and investment, leading to improved financial results.

Another contributing factor to the outperformance of financials is the changing interest rate environment. As central banks around the world adopt more accommodative monetary policies, interest rates are trending lower, creating a favorable environment for financial institutions. Lower interest rates translate to lower borrowing costs for these companies, enabling them to expand their lending activities and improve their profit margins.

Moreover, technological advancements are playing a crucial role in driving the outperformance of financial companies. The emergence of fintech firms and digital platforms has revolutionized the way financial services are delivered, making them more efficient and accessible to a wider range of customers. This digitization of financial services has enabled companies to streamline their operations, reduce costs, and enhance their customer experience, ultimately boosting their financial performance.

In conclusion, the shift in financial performance, with equity performance weakening and financials outperforming, is reflective of the evolving landscape of global markets. Factors such as changing market dynamics, favorable interest rate environments, and technological advancements are reshaping the financial sector and providing new opportunities for growth and investment. Investors and analysts would be wise to take note of these trends and adjust their strategies accordingly to navigate the evolving financial landscape successfully.