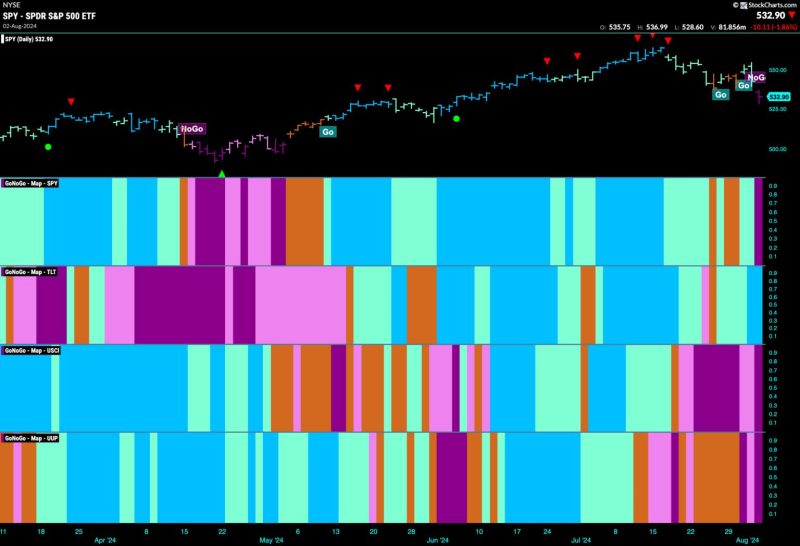

In the ever-changing landscape of financial markets, identifying trends and making informed decisions are crucial aspects of successful investing. One notable trend that has emerged recently is the shift towards defensive stocks as the market index enters a no-go zone. While this shift may signal a cautious approach by investors, understanding the dynamics behind this move can provide valuable insights for navigating the current market environment.

Defensive stocks are typically associated with companies that are less sensitive to economic cycles and tend to perform relatively well during periods of market uncertainty or downturns. These companies often belong to sectors such as healthcare, consumer staples, utilities, and telecommunications, which offer products and services that are considered essential regardless of economic conditions.

The recent move towards defensive stocks can be interpreted as a reflection of investors’ concerns about the overall market environment. As the market index enters a no-go zone, characterized by heightened volatility, economic uncertainty, or geopolitical tensions, investors may be seeking shelter in more stable and defensive sectors to protect their portfolios from potential downside risks.

One key driver behind the shift to defensive stocks is the quest for stability and income generation. In times of market turbulence, investors may prioritize companies with strong fundamentals, consistent cash flows, and attractive dividend yields. Defensive stocks often fit these criteria, making them an attractive option for risk-averse investors looking to weather market storms.

Moreover, the current macroeconomic landscape, marked by factors such as trade tensions, geopolitical conflicts, and slowing global growth, may be prompting investors to adopt a defensive stance. By allocating capital to defensive sectors, investors can hedge against potential market downturns and benefit from the relative stability and resilience of these companies.

It is essential to note that while defensive stocks offer certain benefits during turbulent times, they may not always outperform the broader market during periods of robust economic growth or market rallies. Investors should carefully balance their portfolios by diversifying across different asset classes and sectors to mitigate risks and capture opportunities in various market conditions.

As investors navigate the complexities of the current market environment, staying informed, conducting thorough research, and consulting with financial advisors are essential steps to making well-informed investment decisions. By understanding the dynamics driving the shift towards defensive stocks as the market index enters a no-go zone, investors can position themselves strategically to navigate the challenges and opportunities presented by today’s market conditions.