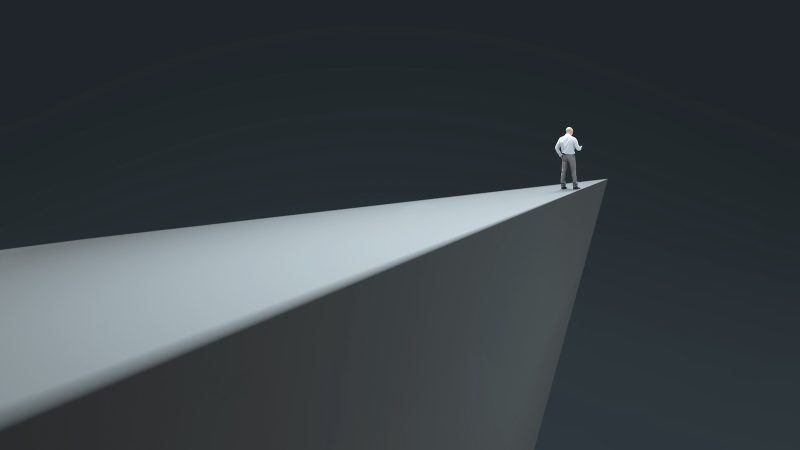

In the world of finance, there are few things more nerve-wracking than watching a market teeter on the edge of a critical level. The NASDAQ, a prominent stock exchange that is home to many of the world’s most innovative and high-growth companies, finds itself in just such a position. Traders and investors alike are closely monitoring several key levels on the NASDAQ, as shifts in these levels could have far-reaching implications for the broader market.

One critical level that has been in focus recently is the 50-day moving average. The 50-day moving average is a widely-watched technical indicator that helps to smooth out price fluctuations and identify trends. When the price of an asset crosses above its 50-day moving average, it is often seen as a bullish sign, indicating that the asset may be entering an uptrend. Conversely, when the price falls below the 50-day moving average, it can be interpreted as a bearish signal.

For the NASDAQ, the 50-day moving average is currently hovering perilously close to the index’s current price. If the NASDAQ were to slip below this key level, it could signal further downside ahead, potentially leading to a more pronounced pullback in the market. On the other hand, if the index manages to hold above the 50-day moving average and rally higher, it could help to bolster bullish sentiment and pave the way for a sustained uptrend.

Another critical level to watch on the NASDAQ is the 200-day moving average. The 200-day moving average is a longer-term indicator that is often used to gauge the overall health of a market or security. Similar to the 50-day moving average, a break below the 200-day moving average could suggest that the market is entering a more prolonged downtrend. Conversely, a bounce off the 200-day moving average could signal that the market is still in a longer-term uptrend.

As the NASDAQ teeters on the edge of these critical levels, traders and investors are anxiously awaiting the next move. Will the index manage to hold above its key moving averages and push higher, or will it succumb to selling pressure and experience a more significant correction? Only time will tell, but one thing is certain: these critical levels are sure to play a crucial role in shaping the future direction of the market.