Market sentiment indicators play a crucial role in helping investors navigate the complex world of financial markets and make informed decisions. In particular, three key indicators can provide valuable insights into the current market sentiment, helping investors gauge whether the prevailing mood is bullish or bearish.

1. **Put/Call Ratio:**

The put/call ratio is a widely used indicator that measures the volume of put options relative to call options being traded on a particular security or index. A high put/call ratio suggests that investors are buying more puts than calls, indicating a bearish sentiment in the market. Conversely, a low put/call ratio may indicate a more bullish outlook.

Investors and traders often use the put/call ratio as a contrarian indicator. A very high put/call ratio could signal excessive fear and potential buying opportunities, while an extremely low ratio may indicate over-optimism and a potential market top.

2. **Volatility Index (VIX):**

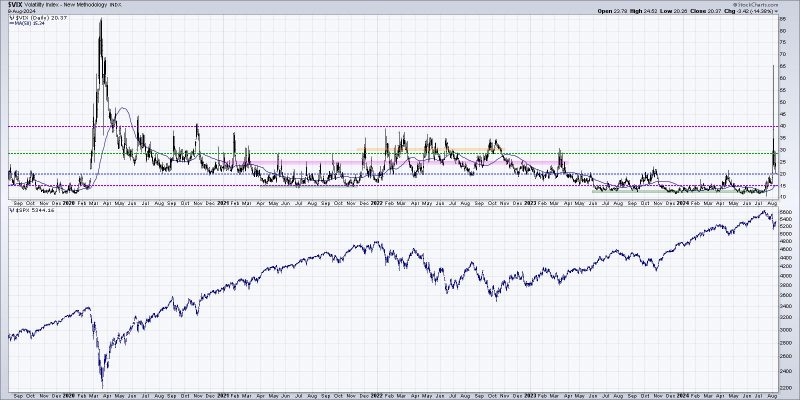

The Volatility Index, also known as the VIX or fear index, measures market volatility and is often considered a key indicator of investor sentiment. A high VIX level suggests increased market uncertainty and fear, typically associated with a bearish market sentiment. Conversely, a low VIX level may indicate complacency and a more bullish sentiment.

Investors use the VIX to gauge market risk and sentiment. A rising VIX may suggest growing concerns among investors and potential market turbulence ahead, while a declining VIX could indicate increasing market stability and confidence.

3. **Investor Sentiment Surveys:**

Various investor sentiment surveys, such as the American Association of Individual Investors (AAII) sentiment survey and the Investors Intelligence sentiment survey, provide valuable insights into investor attitudes, biases, and expectations towards the market. These surveys typically ask respondents whether they are bullish, bearish, or neutral on the market.

High levels of bullish sentiment in these surveys may indicate excessive optimism and a potential contrarian signal for a market correction. Conversely, elevated bearish sentiment could signal fear and pessimism, potentially signaling a market bottom.

In conclusion, monitoring market sentiment indicators is essential for making informed investment decisions and managing risk in the financial markets. By utilizing indicators such as the put/call ratio, Volatility Index (VIX), and investor sentiment surveys, investors can better understand the prevailing market sentiment and position themselves accordingly. Ultimately, combining these indicators with fundamental and technical analysis can provide a comprehensive view of the market environment and help investors navigate periods of both bullish and bearish sentiment.