In the ever-evolving landscape of the financial market, investors constantly seek guidance and analysis to navigate the complex intricacies of trading. As the Nifty index displays a tentative demeanor amidst the development of a defensive setup, it becomes imperative for market participants to grasp key levels and trends that can influence their decision-making process.

At its core, the Nifty index encapsulates the pulse of the Indian stock market, serving as a barometer for the prevailing sentiment and direction of equity markets. In the current scenario, the index’s behavior suggests a cautious approach from investors, with a defensive setup gradually taking shape. This shift towards defensive sectors and assets can be attributed to a variety of factors, ranging from global economic uncertainties to geopolitical tensions and domestic policy changes.

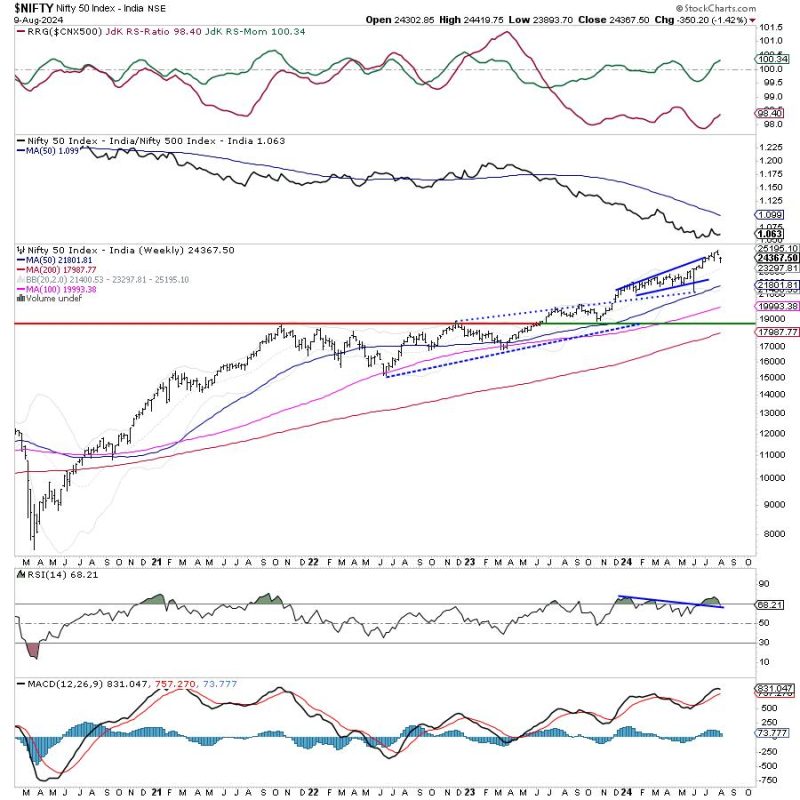

One of the critical aspects to consider during such periods of uncertainty is the identification of key support and resistance levels within the Nifty index. These levels serve as crucial markers that can help investors gauge the strength of market movements and make informed decisions. By closely monitoring these levels and understanding their significance, traders can effectively navigate the market fluctuations and adjust their positions accordingly.

Furthermore, staying attuned to the broader market trends and developments is paramount for investors looking to capitalize on emerging opportunities. The interplay between different sectors, asset classes, and global market dynamics can significantly impact the performance of the Nifty index. By keeping a pulse on these interconnected factors, traders can gain valuable insights into potential market trends and adjust their strategies proactively.

Additionally, market participants should be mindful of external events and catalysts that could influence the Nifty index’s trajectory. Whether it be macroeconomic indicators, corporate earnings reports, or geopolitical developments, staying informed about these external factors can provide a holistic view of the market landscape and enhance decision-making capabilities.

In conclusion, as the Nifty index adopts a tentative stance amidst the development of a defensive setup, market participants must equip themselves with a deep understanding of key levels, market trends, and external factors shaping the market environment. By maintaining a proactive and analytical approach, investors can navigate the complexities of the financial market with confidence and precision, positioning themselves for long-term success and sustainable growth.