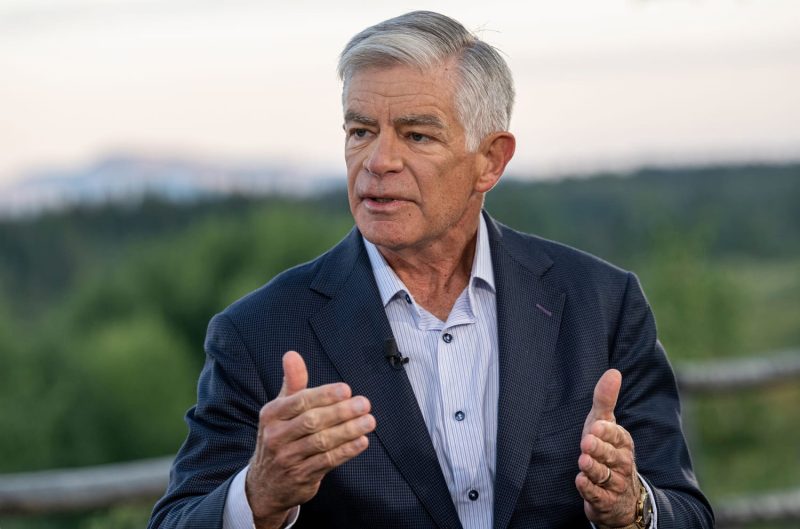

The Federal Reserve is a key player in shaping the economic landscape of the United States, with its decisions on interest rates carrying substantial implications for various sectors. Philadelphia Fed President Patrick Harker has recently voiced his support for an interest rate cut in September. This move comes at a crucial time as the US economy faces challenges amidst global uncertainties.

Harker’s advocacy for an interest rate cut stems from his assessment of the current economic climate. With concerns over a potential economic slowdown and the impacts of trade tensions, Harker believes that a timely rate cut could provide the necessary stimulus to bolster the economy. By lowering interest rates, the Federal Reserve aims to encourage borrowing and spending, thus boosting economic activity.

The decision to advocate for an interest rate cut reflects the Federal Reserve’s commitment to maintaining economic stability and fostering growth. With inflation remaining below the Fed’s target of 2%, there is room for maneuvering on interest rates to support the economy. Harker’s proactive stance highlights the importance of preemptive measures to mitigate risks and uncertainties in the economic outlook.

The implications of an interest rate cut extend beyond the financial markets, impacting businesses and consumers alike. Lower interest rates can lead to reduced borrowing costs for businesses, making investments more attractive and potentially spurring growth in sectors such as manufacturing and construction. For consumers, lower interest rates can translate into lower mortgage rates and increased disposable income, stimulating spending and supporting the overall economy.

However, the effectiveness of an interest rate cut in stimulating economic activity is not without its challenges. As interest rates approach historically low levels, the room for further cuts diminishes, limiting the Fed’s ability to respond to future economic downturns. Moreover, the transmission of monetary policy through the economy may not always yield immediate results, requiring patience and careful monitoring of its impact.

Against the backdrop of global economic uncertainties and trade tensions, the Federal Reserve faces a delicate balancing act in managing economic risks and expectations. Harker’s advocacy for an interest rate cut underscores the Fed’s commitment to supporting economic growth while navigating the evolving economic landscape. Moving forward, the Fed’s decisions on interest rates will continue to shape the trajectory of the US economy and influence market dynamics in the months ahead.