Equities Say Go Fish: How Healthy Are the Markets?

The global equity markets have been subjected to a myriad of challenges and uncertainties lately, leaving investors wondering about their overall health and stability. While the markets have shown resilience amidst the volatility, it is crucial to delve deeper into the various factors influencing their current state. This article aims to explore the health of the equity markets by analyzing key indicators and assessing the potential risks and opportunities that lie ahead.

Market Performance and Volatility

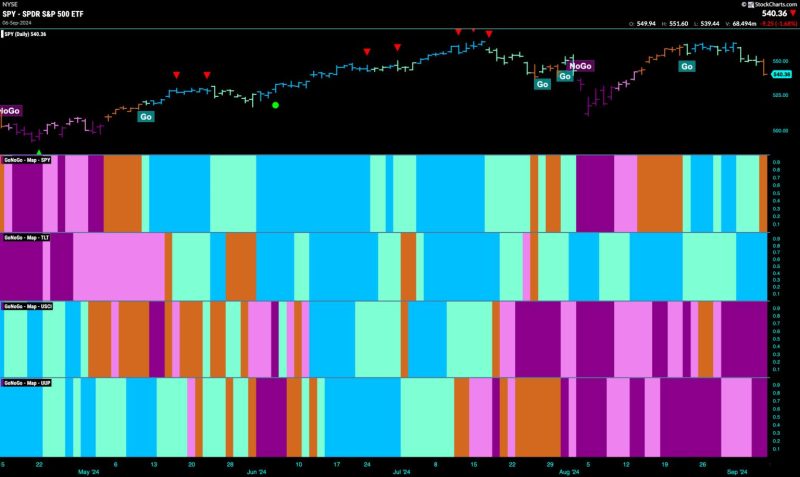

One of the key indicators of the health of the equity markets is their performance over a specified period. In recent months, global stock indices have experienced fluctuations driven by factors such as economic data releases, geopolitical tensions, and central bank policies. Despite these challenges, equities have managed to post impressive gains, indicating underlying strength and investor confidence.

However, the volatility in the markets cannot be overlooked. Sharp swings in stock prices, triggered by sudden news events or market uncertainties, can lead to investor panic and market instability. It is essential for investors to closely monitor market volatility and assess its impact on their investment portfolios to make informed decisions.

Economic Fundamentals and Corporate Earnings

The health of the equity markets is closely tied to the broader economic environment and corporate earnings. Strong economic fundamentals, such as robust GDP growth, low unemployment rates, and stable inflation, provide a favorable backdrop for equities to thrive. Moreover, healthy corporate earnings indicate that businesses are performing well and are likely to generate favorable returns for investors.

On the flip side, economic slowdowns, rising unemployment, or declining corporate profits can exert downward pressure on stock prices. Investors need to track key economic indicators and corporate earnings reports to gauge the health of the equity markets accurately and adjust their investment strategies accordingly.

Interest Rates and Central Bank Policies

Another critical factor influencing the health of the equity markets is interest rates and central bank policies. Central banks play a significant role in shaping monetary policy, which, in turn, affects borrowing costs, inflation expectations, and overall market sentiment. Low-interest rates are generally favorable for equities as they reduce financing costs and stimulate economic growth.

Conversely, rising interest rates can dampen investor enthusiasm for stocks, leading to a sell-off in the markets. Investors should pay close attention to central bank announcements and interest rate decisions to anticipate potential market movements and adjust their portfolios accordingly.

Geopolitical Risks and Market Sentiment

Geopolitical events and global uncertainties can significantly impact the health of the equity markets. Issues such as trade tensions, political instability, or natural disasters can create volatility and uncertainty, prompting investors to flee riskier assets like stocks. Market sentiment plays a crucial role in determining stock prices and investor behavior.

While it is challenging to predict geopolitical developments accurately, investors can manage risks by diversifying their portfolios, staying informed about current events, and maintaining a long-term perspective. By assessing market sentiment and geopolitical risks, investors can make informed decisions to protect their investments and capitalize on potential opportunities in the markets.

Conclusion

In conclusion, the health of the equity markets is influenced by a myriad of factors, including market performance, economic fundamentals, interest rates, and geopolitical risks. While equities have shown resilience amidst challenges, investors must remain vigilant and proactive in monitoring key indicators to navigate market uncertainties successfully. By staying informed, diversifying portfolios, and maintaining a long-term perspective, investors can position themselves for success in the ever-evolving landscape of the global equity markets.