The recent events in the consumer staples sector have sparked concern among investors, signaling a potential shift in the industry landscape. Several key players in the sector have experienced a sense of déjà vu, reminiscent of past market downturns and economic uncertainties. This warning signal suggests that the sector may be facing challenges that could have broader implications for the economy.

One of the primary concerns is the recent decline in consumer spending on staple goods. This trend has been exacerbated by changing consumer preferences and economic uncertainties, leading to decreased demand for traditional staple products. Companies in the sector are struggling to adapt to these shifts, with some experiencing declining sales and profitability.

In addition to changing consumer behaviors, the sector is also grappling with rising input costs and supply chain disruptions. The increasing costs of raw materials, labor, and transportation have put pressure on companies’ margins, leading to lower profitability and financial strain. Some companies have been forced to raise prices to offset these cost increases, further dampening consumer demand.

Another factor contributing to the warning signal in the consumer staples sector is the growing competition from both traditional rivals and new entrants. Established players are facing intensified competition from smaller, more agile competitors who are leveraging technology and innovative business models to gain market share. This increased competition has eroded the pricing power of many staple goods companies, further squeezing their margins.

Moreover, regulatory challenges and changing trade policies have added another layer of uncertainty for companies in the consumer staples sector. Tariffs, trade disputes, and evolving regulations have disrupted supply chains and increased operating costs for many companies. The lack of clarity and predictability in the regulatory environment has made it difficult for companies to plan and invest for the future.

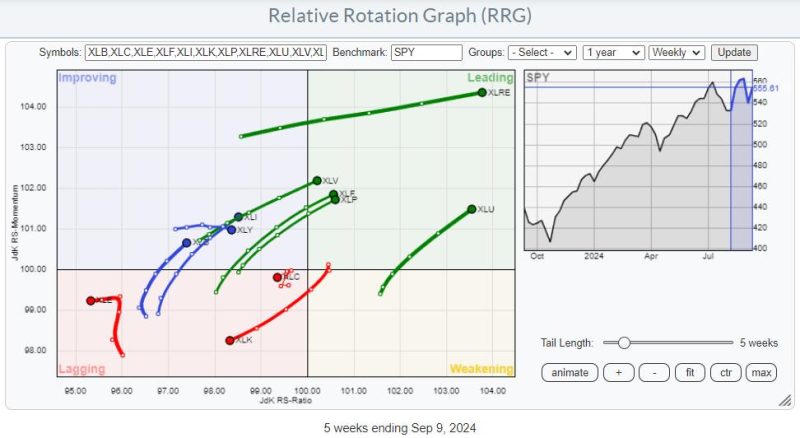

As companies in the consumer staples sector navigate these challenges, investors are closely monitoring their performance and financial health. The recent warning signal in the sector has prompted investors to reassess their exposure to consumer staples stocks and evaluate their risk tolerance. Some investors may opt to reduce their positions in the sector or seek alternative investment opportunities that offer better growth prospects and resilience to market volatility.

In conclusion, the warning signal in the consumer staples sector serves as a wake-up call for companies and investors alike. The challenges facing the sector, including changing consumer preferences, rising costs, increased competition, and regulatory uncertainties, require a proactive and strategic response from companies to navigate the changing landscape successfully. Investors need to stay vigilant and informed to make sound investment decisions in light of the evolving dynamics in the consumer staples sector.