In the realm of finance and investing, the debate over whether rate cuts are bullish or bearish for stock performance has been ongoing. While some investors view rate cuts as a positive stimulus for equities, others interpret them as a signal of economic weakness and impending market downturns. To gain a clearer understanding of how rate cuts truly impact stock performance, it is imperative to delve into the intricacies of monetary policy, economic indicators, and historical market data.

One school of thought suggests that rate cuts are bullish for stocks as they lower borrowing costs for businesses and consumers, thereby stimulating spending and investment. Additionally, lower interest rates make equities more attractive relative to fixed-income securities, leading to increased inflows into the stock market. This influx of capital can drive stock prices higher, creating a favorable environment for investors seeking capital appreciation.

Conversely, another perspective argues that rate cuts can be a bearish indicator for stock performance. In some cases, rate cuts are seen as a response to economic challenges, such as sluggish growth or recessionary pressures. As a result, investors may interpret rate cuts as a signal of underlying weakness in the economy, prompting concerns about corporate profitability and future earnings growth. This sentiment can lead to selling pressure in the stock market, causing stock prices to decline.

The relationship between rate cuts and stock performance is further influenced by other factors such as inflation expectations, market sentiment, and global economic conditions. For instance, if rate cuts are accompanied by lower inflation expectations, investors may become cautious about the outlook for corporate earnings, leading to a more subdued response in the stock market.

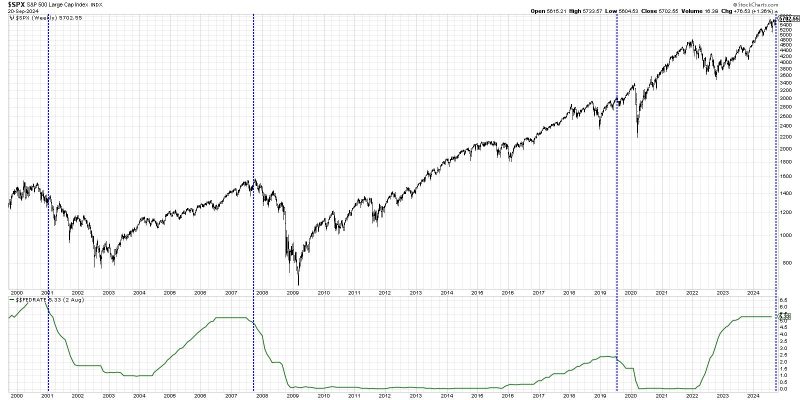

Historical data provides insights into the correlation between rate cuts and stock performance. Past instances of rate cuts by central banks have shown mixed outcomes for equities, with stock markets exhibiting both positive and negative reactions. The impact of rate cuts on stock performance can vary depending on the timing, magnitude, and context in which they occur.

Ultimately, the effect of rate cuts on stock performance is not solely determined by the action itself but rather by the broader economic and market dynamics at play. Investors should consider a holistic view of macroeconomic indicators, company fundamentals, and market valuations when assessing the implications of rate cuts on their investment portfolios.

In conclusion, the truth about rate cuts and stock performance is multifaceted and nuanced. While rate cuts can provide a boost to stock prices in the short term through lower borrowing costs and increased investor appetite, they can also signal underlying economic challenges that may dampen market sentiment. By carefully evaluating the implications of rate cuts within the broader economic context, investors can make informed decisions to navigate the dynamic landscape of financial markets and maximize their investment returns.