The link you have provided serves as a reference for the data and insights shared in this article; however, the content below is a unique and original piece with a focus on the current market trends and valuations.

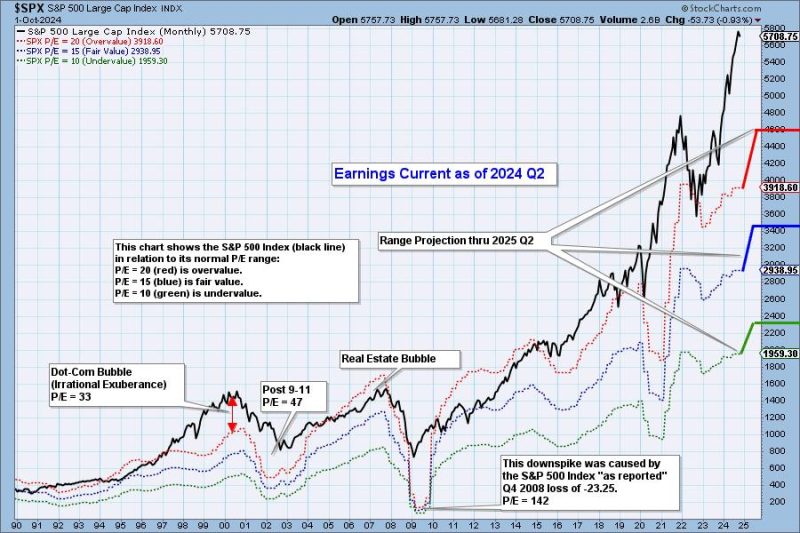

Market analysts across the globe are closely monitoring the latest developments in the financial world, particularly with the release of the second-quarter earnings for 2024. The analysis indicates that the market remains very overvalued, raising concerns among investors and experts alike. This overvaluation stems from various factors that continue to influence the market dynamics and potentially impact investment decisions.

One of the key drivers contributing to the overvaluation of the market is the persistent low-interest-rate environment. Central banks have maintained historically low-interest rates to stimulate economic growth and mitigate the adverse effects of the global pandemic. While these measures have bolstered liquidity and supported asset prices, they have also led to inflated valuations across different sectors. Consequently, investors are faced with the challenge of finding attractive investment opportunities amidst the backdrop of an overheated market.

Moreover, the influx of retail investors into the market has further fueled the overvaluation trend. Platforms offering commission-free trading and easy access to financial markets have empowered individual investors to participate more actively in trading activities. This surge in retail trading has led to heightened market volatility and speculative behavior, contributing to inflated asset prices that may not necessarily reflect the underlying fundamentals of the companies.

Another factor amplifying the market overvaluation is the dominance of technology stocks. The technology sector has been a prominent driver of market growth in recent years, with leading companies commanding substantial market capitalizations and high valuations. As investors continue to flock towards tech stocks in search of growth opportunities, the sector’s disproportionate influence on market valuation becomes increasingly evident.

Additionally, the prevalence of IPOs and SPACs (Special Purpose Acquisition Companies) has added to the market’s overvaluation concerns. The surge in new listings and the proliferation of SPAC deals have generated excitement among investors but have also raised questions about the sustainability of such valuations. The rush to invest in newly public companies, often backed by celebrity endorsements or ambitious growth projections, has further inflated market values and increased the risk of speculative bubbles.

In light of these factors, investors are advised to exercise caution and conduct thorough due diligence before making investment decisions. While the market may offer opportunities for growth, the current environment of overvaluation and heightened risk necessitates a prudent and strategic approach to portfolio management. Diversification, risk mitigation strategies, and a focus on long-term fundamentals are crucial in navigating the complexities of an overvalued market.

In conclusion, the prevailing trends of market overvaluation underscore the importance of disciplined investment practices and informed decision-making. As market dynamics continue to evolve, staying vigilant, being mindful of risks, and seeking guidance from qualified financial advisors are imperative to safeguarding portfolios and achieving sustainable returns in an environment where caution and prudence are paramount.