Certainly! Here is the article:

Key Points to Focus on While Nifty Consolidates

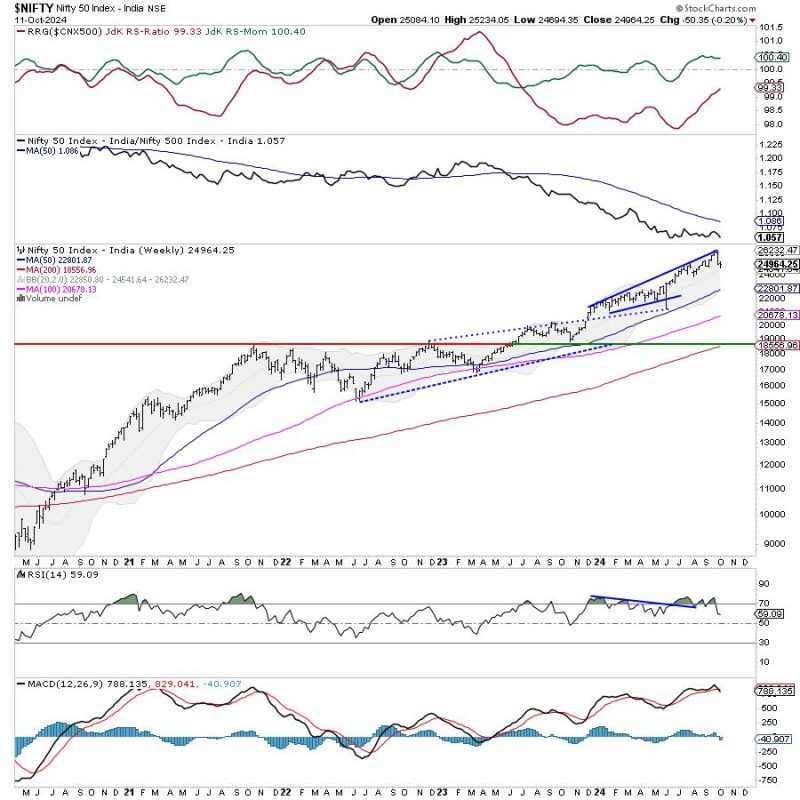

Support and Resistance Levels: It is crucial for traders and investors to keep a close eye on the support and resistance levels during a consolidation phase. Support levels act as a floor for the index while resistance levels act as a ceiling. By being aware of these key levels, traders can make informed decisions on their entry and exit points in the market.

Volume Analysis: Volume analysis plays a significant role in determining the strength of a particular movement in the market. During a consolidation phase, observing the trading volume can provide valuable insights into whether the market is likely to breakout or continue consolidating. High volume during a breakout can indicate a strong trend continuation.

Technical Indicators: Utilizing technical indicators can help traders identify potential opportunities during a consolidation phase. Indicators such as moving averages, Relative Strength Index (RSI), and Bollinger Bands can provide valuable signals for decision-making. By understanding how these indicators work in conjunction with price action, traders can enhance their trading strategies.

Market Sentiment: Market sentiment refers to the overall feeling or attitude of investors towards the market. During a consolidation phase, it is important to gauge market sentiment as it can influence the direction of the market. Positive sentiment can lead to bullish movements, while negative sentiment can result in bearish movements. Keeping an eye on news and events impacting the market sentiment is crucial.

Risk Management: Risk management is paramount for traders and investors, especially during a consolidation phase. By implementing proper risk management techniques such as setting stop-loss orders, position sizing, and diversification, traders can protect their capital and minimize potential losses. It is essential to have a clear risk management plan in place to navigate through the uncertainties of the market.

Psychological Stability: Emotions can often cloud judgment and lead to irrational decision-making in the market. During a consolidation phase, it is important for traders to maintain psychological stability and discipline. By staying calm and following a well-thought-out trading plan, traders can avoid impulsive actions that may jeopardize their trading success.

In conclusion, navigating through a consolidation phase requires a strategic approach and a keen understanding of market dynamics. By focusing on key aspects such as support and resistance levels, volume analysis, technical indicators, market sentiment, risk management, and psychological stability, traders can position themselves effectively to capitalize on opportunities while minimizing risks. Staying informed and disciplined is essential in achieving trading success during periods of market consolidation.