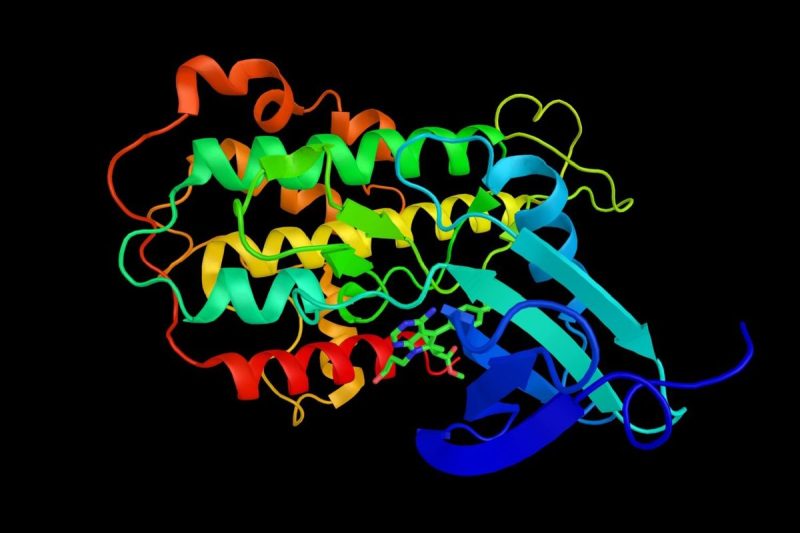

AlphaFold, the cutting-edge artificial intelligence system developed by DeepMind, has been creating waves in the scientific community due to its remarkable capabilities in protein folding prediction. With its potential for revolutionizing drug discovery, understanding diseases, and accelerating bioengineering, many investors are eager to capitalize on AlphaFold’s success by investing in the company behind it, DeepMind Technologies.

Investing in AlphaFold stock can be a lucrative opportunity for those looking to gain exposure to the rapidly growing field of artificial intelligence and biotechnology. However, before diving into this investment, it’s essential to understand some key aspects related to AlphaFold, DeepMind, and the stock market.

First and foremost, investors should thoroughly research both DeepMind Technologies and its parent company, Alphabet Inc. Understanding DeepMind’s business model, financial performance, key partnerships, and strategic direction can provide valuable insights into the company’s growth prospects and potential risks.

Moreover, it’s crucial to have a clear understanding of the competitive landscape in the artificial intelligence and biotechnology sectors. Analyzing other players in the market, their technologies, and how they compare to AlphaFold can help investors gauge DeepMind’s position and potential for future success.

When considering investing in AlphaFold stock, investors should also take into account broader market trends, economic conditions, and regulatory developments that could impact the company’s growth trajectory. Being aware of potential macroeconomic risks and industry-specific challenges can help investors make informed decisions and manage their investment portfolios effectively.

Furthermore, investors should pay attention to news, updates, and announcements related to DeepMind Technologies and AlphaFold. Staying informed about the company’s latest developments, research breakthroughs, partnerships, and product launches can provide valuable insights into its future growth potential and market performance.

Lastly, investors should carefully assess their risk tolerance, investment objectives, and financial situation before investing in AlphaFold stock. Diversifying their investment portfolio, setting realistic financial goals, and consulting with financial advisors can help investors navigate the complexities of the stock market and achieve their investment objectives successfully.

In conclusion, investing in AlphaFold stock can offer significant potential returns for investors looking to capitalize on the groundbreaking technology developed by DeepMind Technologies. By conducting thorough research, understanding the market landscape, staying informed about company developments, and assessing their own risk tolerance, investors can make well-informed decisions and potentially benefit from the growth of AlphaFold in the years to come.