When it comes to investing in semiconductor stocks, Exchange-Traded Funds (ETFs) offer investors an efficient way to gain exposure to this ever-evolving sector. Among the various semiconductor ETFs available in the market, two popular options are the VanEck Vectors Semiconductor ETF (SMH) and the iShares PHLX Semiconductor ETF (SOXX). Despite both being prominent players in the semiconductor industry, SMH has demonstrated more resilience compared to SOXX during recent market fluctuations.

One of the primary reasons behind SMH’s relative strength is its diversified portfolio. SMH holds a broader range of semiconductor companies compared to SOXX, which results in a more balanced exposure to the overall sector. By spreading its holdings across various subsectors within the semiconductor industry, SMH reduces the risk associated with holding a concentrated portfolio. This diversification has proven beneficial during periods of market volatility, enabling SMH to withstand market downturns better than its counterpart.

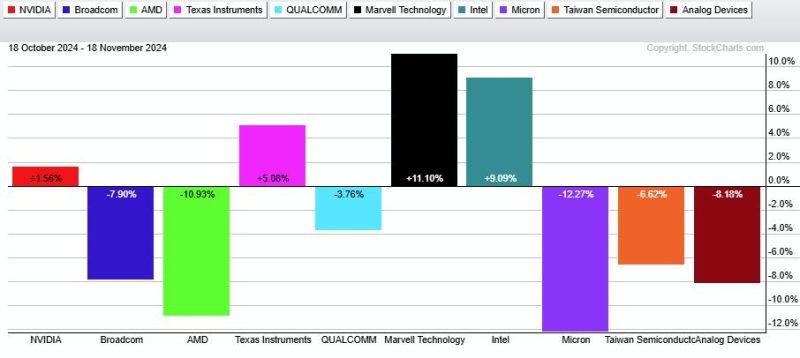

Another factor contributing to SMH’s outperformance is its exposure to key semiconductor players that have shown strong performance. SMH includes semiconductor giants like NVIDIA and AMD, which have been delivering solid financial results and advancing technology innovations. These companies have played a crucial role in driving SMH’s performance, making it a preferred choice for investors seeking exposure to successful semiconductor firms.

Furthermore, SMH’s weighting methodology may also be a contributing factor to its resilience. SMH employs a modified market-cap weighting approach that takes into account factors beyond mere market capitalization. This methodology allows SMH to adjust its holdings based on various criteria such as revenue, earnings, and liquidity, which can result in a more balanced and stable portfolio composition.

On the other hand, SOXX has a more concentrated portfolio, with a significant portion of its assets allocated to a few large semiconductor companies. While this strategy can lead to significant gains when these companies perform well, it also exposes SOXX to higher risk if any of these key holdings underperform. The concentrated nature of SOXX’s portfolio makes it more vulnerable to market fluctuations, which can explain its relatively weaker performance compared to SMH.

In conclusion, the tale of these two semiconductor ETFs emphasizes the importance of diversification and portfolio composition in the world of investing. SMH’s diversified portfolio, exposure to strong-performing companies, and thoughtful weighting methodology have enabled it to hold up better than SOXX during challenging market conditions. As investors navigate the dynamic semiconductor sector, understanding the nuances of different ETFs can help them make informed decisions and build resilient investment portfolios.