As we delve into the intricate world of financial markets, exploring the movements of currencies and the broader implications they may carry is paramount. In a recent analysis by godzillanewz.com, the focus has shifted towards the US dollar (USD) and the potential for a significant rally in the near future.

The USD has been subject to various fluctuations over time, influenced by a multitude of factors ranging from economic data and geopolitical events to market sentiment and central bank policies. As the world’s primary reserve currency, the performance of the USD often serves as a barometer for global economic conditions.

In the recent analysis provided by godzillanewz.com, several indicators suggest that the USD may be gearing up for a strong rally. One key factor highlighted is the US Federal Reserve’s stance on monetary policy. The Federal Reserve plays a crucial role in setting interest rates and implementing monetary stimulus measures, which can directly impact the value of the USD.

Furthermore, economic data such as GDP growth, inflation rates, and employment figures can also sway market perceptions of the USD. Investors often closely monitor these indicators to gauge the health of the US economy and anticipate potential shifts in currency valuations.

Geopolitical events and trade relations can also exert significant influence on the USD. Trade tensions, diplomatic developments, and global economic dynamics all play a part in shaping market sentiment towards the USD. A favorable resolution to trade disputes or improved international relations can bolster the USD’s standing in the currency markets.

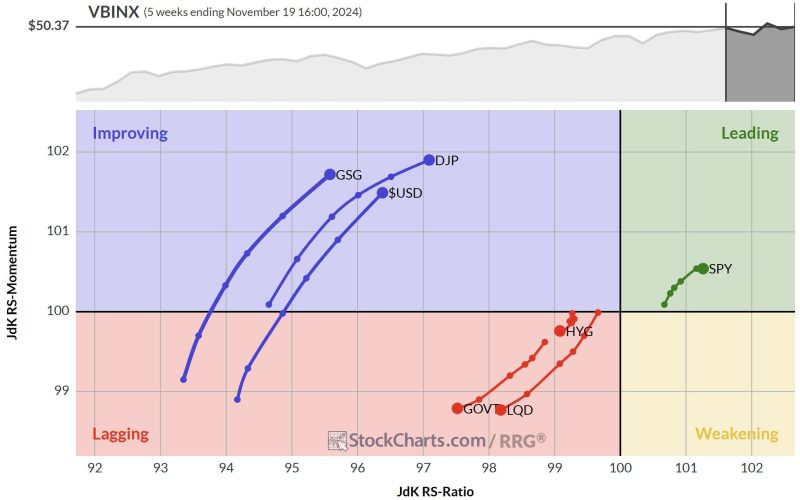

Technical analysis is another tool employed by market participants to forecast currency movements. Chart patterns, trend lines, and key support and resistance levels can provide valuable insights into potential price trajectories. Traders and analysts often utilize technical indicators to identify entry and exit points for trades in the currency markets.

Risk sentiment and market volatility are additional factors that can impact the USD’s performance. Heightened uncertainty or geopolitical instability may drive investors towards safe-haven assets such as the USD, boosting its value relative to other currencies.

In conclusion, the analysis presented by godzillanewz.com sheds light on the potential for a USD rally in the foreseeable future. While market dynamics are subject to change and unforeseen events can alter the landscape at any moment, staying informed and monitoring key indicators can help investors navigate the intricacies of the currency markets and make informed decisions regarding their portfolios. As the USD continues to play a pivotal role in the global economy, staying attuned to its movements and underlying factors is essential for market participants seeking to capitalize on potential opportunities in the currency markets.