The ATR Trailing Stop: A Powerful Tool for Trade Management and Trend Definition

Section 1: Understanding the ATR Indicator

The Average True Range (ATR) indicator is a popular technical analysis tool used by traders to measure market volatility. Unlike other oscillators that focus on price movements, the ATR indicator evaluates the range of price movements over a specified period. This makes ATR a valuable tool for assessing market volatility and managing risk in trading.

Section 2: Implementing the ATR Trailing Stop

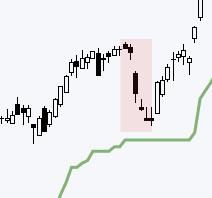

One of the key applications of the ATR indicator is in setting trailing stops. The ATR Trailing Stop is a dynamic stop-loss technique that adjusts based on the market’s volatility. By setting the stop-loss level as a multiple of the ATR, traders can account for fluctuations in price movements and avoid premature exits or staying in a trade for too long.

Section 3: Managing Trades with the ATR Trailing Stop

Using the ATR Trailing Stop can help traders effectively manage their trades by providing a systematic way to lock in profits and protect against losses. By adjusting the stop-loss level based on the ATR, traders can trail their positions and let profits run while limiting downside risk. This approach allows traders to stay in profitable trades longer and exit losing positions before significant losses occur.

Section 4: Defining Trends with the ATR Indicator

In addition to managing trades, the ATR indicator can also be used to define trends in the market. By comparing the current ATR value to historical levels, traders can gauge the strength of a trend. Rising ATR values indicate increasing volatility and potentially stronger trends, while decreasing ATR values may signal a weakening trend or potential reversal.

Section 5: Combining the ATR Trailing Stop with Other Tools

To enhance trading strategies, traders can combine the ATR Trailing Stop with other technical indicators or chart patterns. For example, using the ATR in conjunction with moving averages or trend lines can provide additional confirmation signals for trade entries and exits. By integrating the ATR indicator with other tools, traders can build robust trading systems with improved accuracy and effectiveness.

Section 6: Conclusion

In conclusion, the ATR Trailing Stop is a powerful tool for trade management and trend definition in the financial markets. By leveraging the ATR indicator to set dynamic stop-loss levels and assess market volatility, traders can make more informed decisions and improve their overall trading performance. Incorporating the ATR Trailing Stop into trading strategies can help traders navigate volatile market conditions and enhance risk management practices for more consistent and profitable trading outcomes.