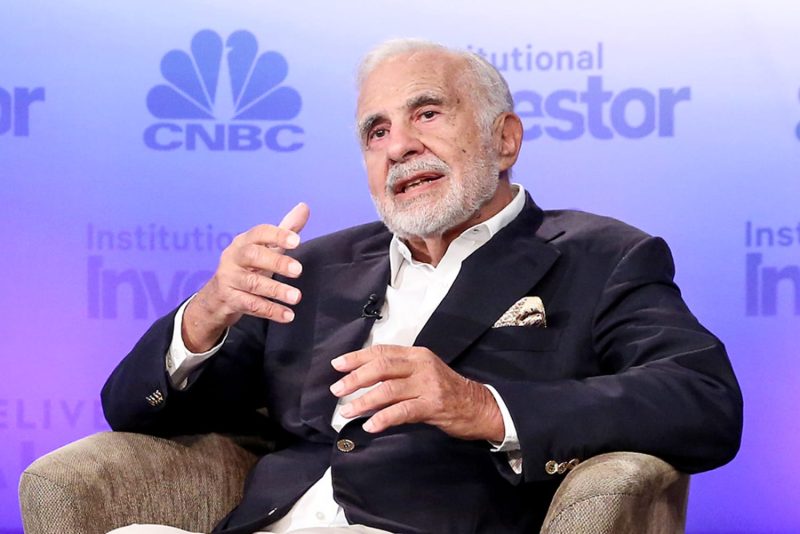

The Securities and Exchange Commission (SEC) has recently filed charges against renowned investor Carl Icahn, accusing him of concealing billions of dollars’ worth of stock pledges. This scandal has reverberated through the financial world, shaking investor confidence and raising questions about transparency and accountability in high-stakes investments.

The SEC alleges that Icahn violated anti-fraud provisions by failing to disclose his significant ownership in various companies as required by law. According to the complaint, Icahn had entered into agreements that allowed him to obtain substantial ownership in these companies through cash-settled equity swaps. However, instead of disclosing these arrangements, he allegedly kept them hidden, depriving regulators and the public of crucial information about his true holdings and potential influence over these companies.

Icahn’s stature in the financial industry makes this case particularly concerning. As a billionaire investor with a long and storied career, Icahn’s actions carry significant weight and can sway markets. The fact that he is accused of engaging in deceptive practices that undermine market integrity raises serious questions about the effectiveness of existing regulations and the need for stronger oversight mechanisms.

The SEC’s decision to pursue charges against Icahn reflects a broader effort to crack down on financial misconduct and ensure that all market participants play by the rules. By holding even high-profile individuals like Icahn accountable for their actions, the SEC sends a signal that no one is above the law and that consequences will be enforced for those who try to manipulate the system for personal gain.

Investors, both big and small, rely on accurate and timely information to make informed decisions. When prominent figures like Icahn allegedly withhold crucial details about their holdings, it undermines the integrity of the entire market and erodes trust among stakeholders. Transparency and disclosure are essential pillars of a fair and efficient financial system, and any attempts to subvert these principles must be met with swift and decisive action.

Moving forward, this case serves as a stark reminder of the importance of regulatory vigilance and the need for ongoing reforms to prevent similar abuses in the future. It also underscores the critical role that enforcement agencies like the SEC play in safeguarding the integrity of our financial markets and holding wrongdoers accountable.

As the legal proceedings unfold, the outcome of the SEC’s charges against Carl Icahn will be closely watched by investors, regulators, and the public alike. The case has already sparked discussions about corporate governance, accountability, and the responsibilities that come with wielding significant influence in the financial world. Ultimately, it serves as a cautionary tale about the consequences of flouting the rules and the importance of upholding the principles of transparency and fair play in our markets.