In the financial markets, analyzing price movements is essential for making informed investment decisions. There are various methods and tools available for market participants to interpret and understand the market trends. While some traders prefer technical analysis, others rely on fundamental analysis to assess the underlying value of securities. However, no matter the approach, it is crucial to put market moves into perspective to gain a holistic view of the situation.

When it comes to analyzing the markets, one key index that often garners significant attention is the Nifty. The Nifty is a benchmark index of the National Stock Exchange of India (NSE) that consists of 50 large-cap Indian companies across various sectors. Due to its broad representation of the Indian stock market, the Nifty is closely monitored by investors, analysts, and traders alike.

One approach to gaining perspective on the Nifty’s market moves is to look at it from a technical analysis standpoint. Technical analysis involves studying past price movements and volume data to forecast future price movements. By analyzing charts and technical indicators, traders can identify trends, support and resistance levels, and potential entry and exit points for trades.

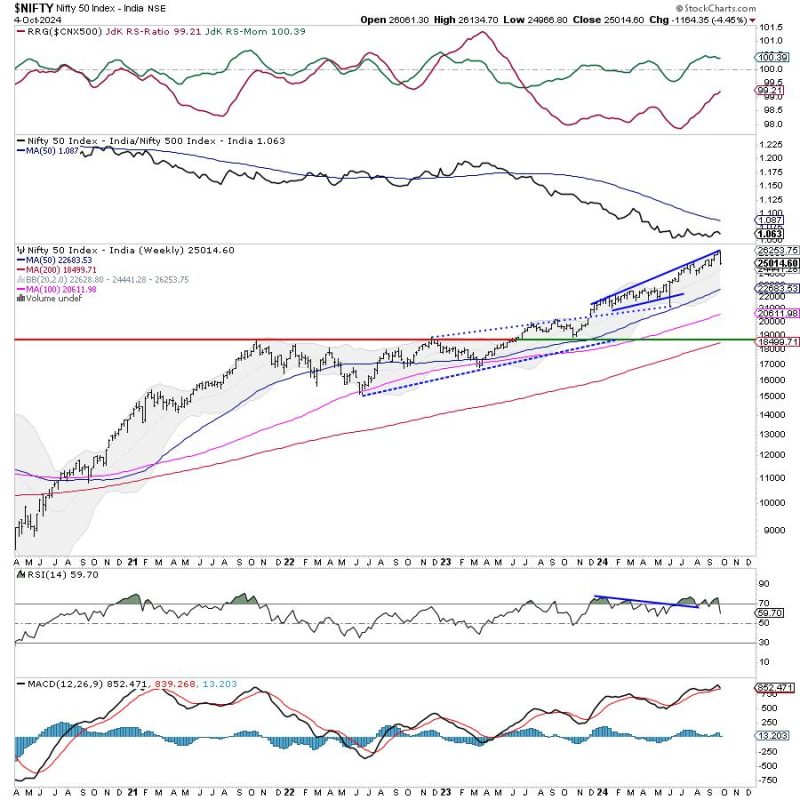

Looking at the Nifty from a technical analysis perspective, traders may use tools such as moving averages, trendlines, and momentum indicators to assess the market’s strength and direction. For instance, moving averages can help traders identify the overall trend of the market, while trendlines can indicate potential areas of support or resistance.

Moreover, momentum indicators like the Relative Strength Index (RSI) or the Moving Average Convergence Divergence (MACD) can provide insights into the strength of a trend and potential trend reversals. By analyzing these indicators alongside price action, traders can make more informed decisions about when to enter or exit trades.

Another way to put Nifty’s market moves into perspective is to consider fundamental analysis. Fundamental analysis involves evaluating the financial health and performance of companies to determine their intrinsic value. By analyzing factors such as earnings, revenue growth, profitability, and macroeconomic data, investors can assess whether a stock is undervalued or overvalued.

When applying fundamental analysis to the Nifty, traders can look at factors such as the overall economic climate, corporate earnings reports, and government policies that may impact the stock market. By understanding the underlying factors driving market movements, traders can make more informed decisions about their investments.

In conclusion, gaining perspective on market moves, especially regarding indices like the Nifty, is crucial for successful trading and investing. Whether through technical analysis, fundamental analysis, or a combination of both, market participants can better understand the dynamics of the market and make informed decisions. By analyzing trends, indicators, and fundamental factors, traders can navigate the markets with more confidence and increase their chances of success.