In the stock market, especially in reference to the Nifty index, traders and investors often closely monitor key levels and technical indicators to gauge the potential direction of the market. Analyzing historical data and studying chart patterns can provide valuable insights that can help market participants make informed decisions and manage risks effectively.

One of the critical aspects highlighted in the provided source is the potential for the Nifty index to remain in a range-bound trading pattern in the upcoming week. This suggests that the market may lack a clear trend and may exhibit sideways movements within a defined price range. While range-bound markets present challenges for trend followers and momentum traders, they also offer opportunities for range-bound strategies such as mean reversion and range trading.

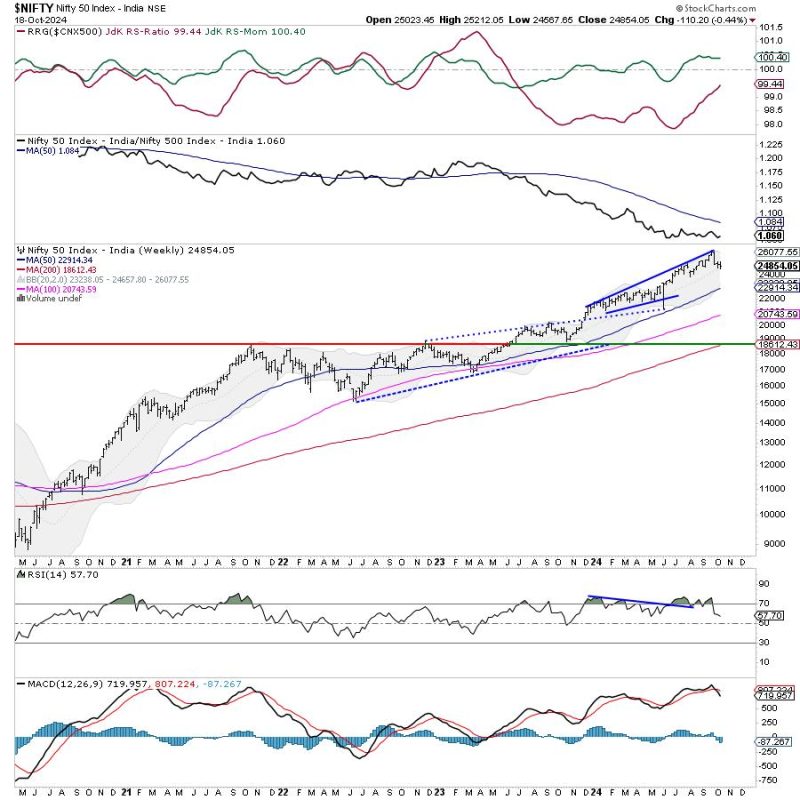

The article emphasizes that trending moves are more likely to occur only if specific key levels or edges are breached. These edges could refer to important support or resistance levels, moving averages, or trendlines that act as barriers for price movements. When these key levels are breached decisively, it often signals a shift in market sentiment and can trigger strong trending moves in the direction of the breakout.

Technical analysis plays a crucial role in identifying these key levels and edges in the market. Traders use a combination of tools such as trend lines, Fibonacci retracement levels, moving averages, and momentum oscillators to assess the strength of prevailing trends and potential reversal points. By incorporating both trend-following and mean reversion strategies, traders can adapt to different market conditions and capitalize on trading opportunities.

Moreover, risk management is a fundamental aspect of successful trading in any market environment. Setting stop-loss orders, position sizing based on risk tolerance, and adhering to a disciplined trading plan are essential practices that can help traders navigate volatile market conditions and protect capital. Additionally, being aware of major economic events, corporate earnings releases, and geopolitical developments can also influence market dynamics and impact trading decisions.

In conclusion, while the Nifty index may experience range-bound trading in the week ahead, the potential for trending moves exists if key levels are breached. By employing technical analysis tools, implementing sound risk management practices, and staying informed about market news and events, traders can position themselves to take advantage of opportunities in the market and manage risks effectively. Adapting to changing market conditions and being prepared for different scenarios are essential qualities for successful trading in the dynamic world of financial markets.