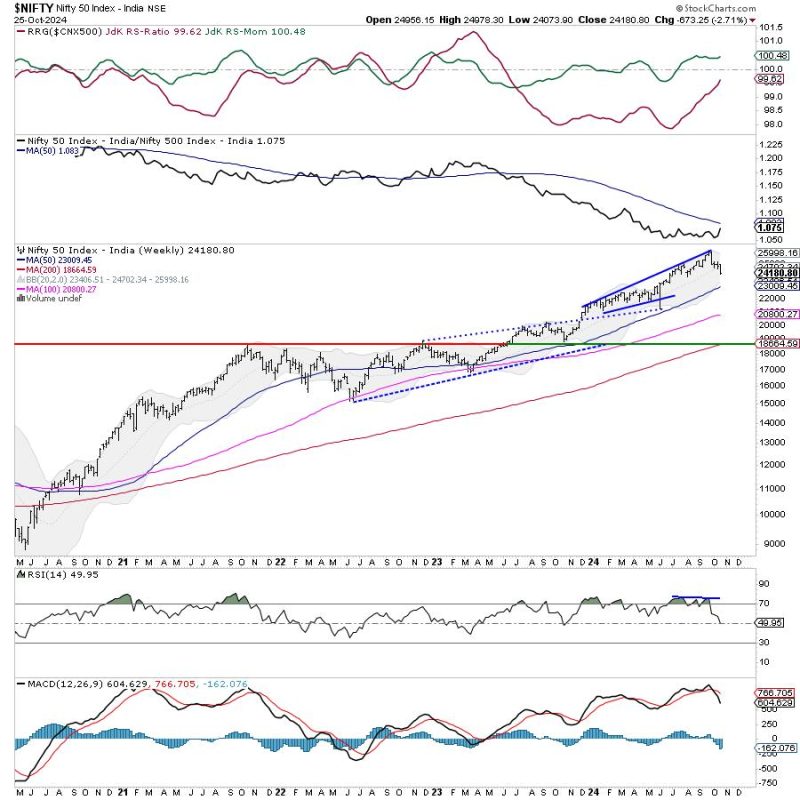

The overall market sentiment has been bearish, with the Nifty 50 index breaching key support levels and dragging resistance lower. The downward movement in the index has reflected the prevailing uncertainties and cautious approach among investors. In the week ahead, traders and investors will likely closely monitor key technical levels and news flow that could impact market sentiment.

Analysts have pointed to the breach of the 200-day moving average as a significant bearish signal for the Nifty 50. This technical indicator is often used to gauge the long-term trend of the market, and its violation could signal further downside potential. Additionally, the lower highs and lower lows pattern observed in the index further emphasizes the prevailing bearish sentiment.

The resistance levels in the Nifty 50 have been lowered, reflecting the continued selling pressure in the market. Traders will be keen to watch how the index reacts around these lowered resistance levels, as a decisive break above could signal a potential reversal in the short term. However, until such a breakout occurs, the bias remains tilted towards the downside.

Market participants will also closely monitor global developments and news flow that could impact market sentiment. Geopolitical tensions, economic data releases, and corporate earnings announcements are among the factors that could influence investor sentiment in the week ahead. Any unexpected developments in these areas could lead to increased volatility in the market.

In conclusion, the Nifty 50 index has violated key support levels and dragged resistance lower, reflecting the prevailing bearish sentiment in the market. Traders and investors will closely monitor technical levels and news flow in the week ahead to gauge the potential direction of the market. The breach of the 200-day moving average and the lower highs and lower lows pattern signal downside risks, while a decisive break above lowered resistance levels could hint at a possible reversal in the short term. Global developments and news flow will also play a crucial role in shaping market sentiment in the coming days.