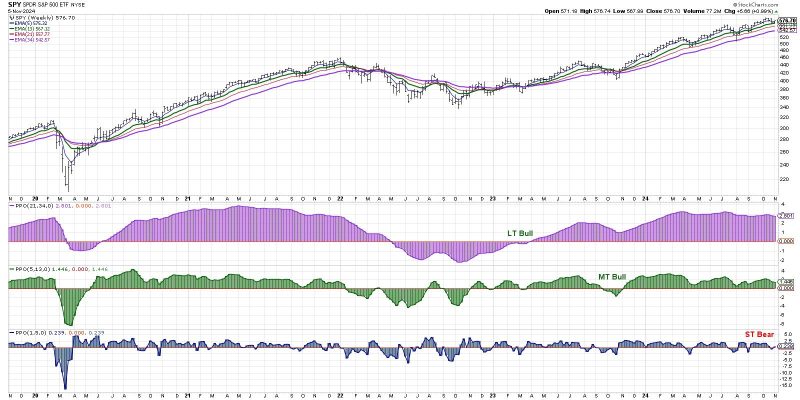

Short-Term Bearish Signal as Markets Brace for News-Heavy Week

The recent market developments have signalled a short-term bearish trend, with investors bracing for a news-heavy week ahead. Various factors have contributed to this downturn, prompting caution among market participants.

One of the key drivers of the bearish sentiment is the upcoming slew of economic data releases and central bank announcements. These can have a significant impact on market sentiment and pricing, leading to increased volatility as investors adjust their positions accordingly. Uncertainty surrounding these events often leads to a risk-off environment, where investors prefer safer assets over riskier ones.

In addition, geopolitical tensions and trade disputes have added to the market’s unease. Escalating conflicts between major economies can disrupt global trade flows and business confidence, affecting corporate earnings and economic growth. The uncertainty surrounding these issues can dampen investor sentiment and lead to increased market jitters.

Furthermore, technical indicators are also pointing towards a short-term bearish outlook. Various technical measures, such as moving averages, relative strength index (RSI), and MACD, are showing signs of weakness, suggesting that the market may be due for a correction. Investors closely monitor these indicators to gauge market sentiment and identify potential turning points.

Investors are advised to exercise caution and stay informed about upcoming events that may impact market dynamics. Diversification and risk management strategies are crucial during times of heightened uncertainty to protect capital and navigate volatile market conditions. Keeping a close eye on news developments and economic releases can help investors stay ahead of market trends and make informed decisions.

In conclusion, the current short-term bearish signal in the markets reflects a combination of factors, including upcoming news-heavy events, geopolitical tensions, and technical weakness. By staying vigilant and adopting prudent risk management strategies, investors can navigate the turbulent market environment and position themselves for potential opportunities as the situation evolves.