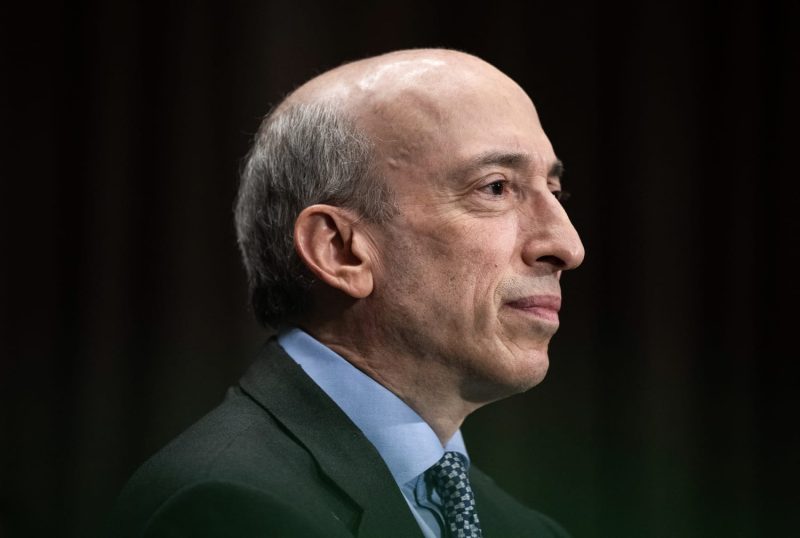

In the world of securities regulation, leadership transitions at key regulatory agencies can have significant implications for market participants and investors alike. The recent announcement of Securities and Exchange Commission (SEC) Chair Gary Gensler’s decision to step down on January 20 has sparked speculation about the potential implications of his departure and who might succeed him in leading the critical agency.

As Gary Gensler prepares to vacate his position, he leaves behind a legacy of ambitious regulatory initiatives aimed at enhancing transparency, accountability, and fairness in the capital markets. During his tenure, Gensler led the SEC in efforts to tackle issues such as market manipulation, insider trading, and the implementation of new regulations to address emerging risks posed by advancements in technology and digital assets.

One of the key accomplishments of Gensler’s tenure was his focus on enhancing regulatory oversight of cryptocurrency markets. Under his leadership, the SEC took steps to clarify the regulatory framework for digital assets, cracking down on fraudulent initial coin offerings (ICOs) and asserting its authority over the burgeoning crypto ecosystem. Gensler’s proactive stance on digital assets has brought greater clarity to a previously murky regulatory landscape and signaled the SEC’s willingness to adapt to the evolving dynamics of the modern financial system.

As Gensler prepares to step down, the question now arises as to who will succeed him as the next SEC Chair. Given the timing of his departure on January 20, speculation has arisen about the possibility of a replacement being appointed by former President Donald Trump. Trump, who has consistently advocated for deregulation and market-friendly policies, could potentially nominate a candidate who aligns with his vision for the SEC and its role in overseeing the capital markets.

The appointment of a new SEC Chair will undoubtedly have implications for the direction of securities regulation in the United States. The incoming Chair will inherit a critical mandate to uphold investor protection, ensure fair and efficient markets, and promote capital formation. The selection of a candidate with a strong background in securities law, regulatory experience, and a nuanced understanding of the complexities of modern finance will be crucial in maintaining the SEC’s credibility and effectiveness as a regulatory authority.

In conclusion, Gary Gensler’s impending departure as SEC Chair marks the end of an era characterized by ambitious regulatory reforms and a proactive approach to addressing emerging risks in the financial markets. As the SEC prepares for a leadership transition, the selection of a new Chair will shape the future trajectory of securities regulation and determine the agency’s ability to adapt to the evolving landscape of finance. Investors, market participants, and industry stakeholders will closely watch the succession process to gauge the direction of regulatory policy under the incoming leadership.