VIX Spikes Above 16: Is This the End?

In the world of investing, volatility is a factor that can make or break portfolios. On October 13, 2021, the CBOE Volatility Index, known as the VIX, spiked above 16, causing panic among investors. But is this spike in the VIX a sign of the end of the current bull market, or is it just a temporary blip in an otherwise steady climb?

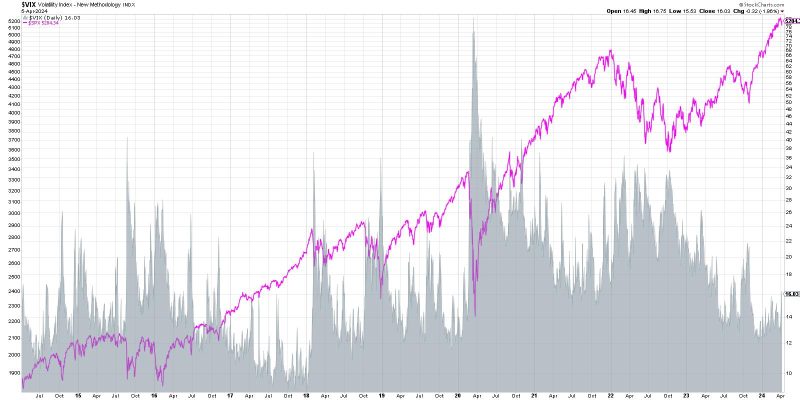

To understand the implications of the VIX spike, it’s essential to delve into what the VIX represents. Also known as the fear gauge, the VIX measures market expectations of near-term volatility conveyed by S&P 500 stock index option prices. When the VIX is low, it signifies that investors are complacent about market conditions and expect little volatility. Conversely, when the VIX is high, it indicates that investors are fearful of potential market fluctuations.

The recent spike above 16 in the VIX can be attributed to various factors, including geopolitical tensions, economic data releases, and concerns about the Federal Reserve’s monetary policy. For instance, the ever-evolving situation in Afghanistan, rising inflation rates, and uncertainties surrounding tapering of asset purchases by the Fed have all contributed to heightened market volatility.

While a spike in the VIX can trigger knee-jerk reactions from investors, it is essential to maintain a long-term perspective. Historically, VIX spikes have often been followed by periods of market consolidation or pullbacks, rather than signaling the end of a bull market. In fact, increased volatility can present opportunities for savvy investors to capitalize on market downturns by buying undervalued assets.

Moreover, the VIX spike above 16 may simply be a reflection of short-term market jitters rather than a fundamental shift in market sentiment. Investors should remain cautious but refrain from making impulsive investment decisions based solely on VIX levels. Instead, conducting thorough research, diversifying portfolios, and staying informed about market trends can help navigate turbulent times in the market.

In conclusion, while the VIX spike above 16 may have spooked investors, it is important to maintain a balanced perspective and avoid succumbing to fear-induced selling. Market volatility is a natural part of investing, and periods of heightened volatility can offer opportunities for those who remain calm and strategic in their investment approach. By staying informed, disciplined, and focused on long-term goals, investors can weather market storms and emerge stronger on the other side.