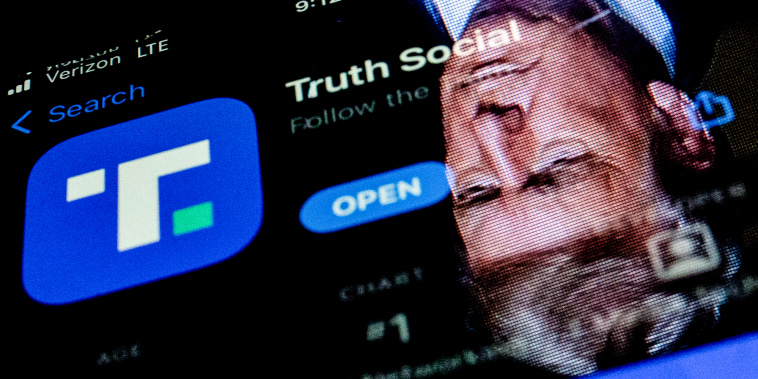

In the world of business and finance, stock shares play a critical role in determining the value of a company and its market performance. One recent example that has captured the attention of investors and analysts alike is the news of media shares associated with the former U.S. President, Donald J. Trump. A notable plunge in Trump Media’s shares followed the company’s filing to issue additional DJT stock, signaling a significant development in the company’s trajectory and spurring speculation among market participants.

The decision by Trump Media to file for the issuance of additional DJT stock has raised eyebrows and triggered a sharp decline in the company’s share prices. This move signifies a strategic shift in the company’s capital structure and long-term funding plans. By creating more DJT shares, Trump Media aims to potentially raise capital by issuing these new shares to investors or the public, thus increasing its financial resources for expansion, acquisitions, or other corporate activities.

The reaction from the market to this announcement has been swift and pronounced, with Trump Media’s share prices taking a hit following the news. Shareholders and potential investors are closely monitoring the situation to gauge the potential implications of the increased DJT stock issuance on the company’s financial health and overall market performance. The drop in share prices reflects investors’ concerns and uncertainties regarding the future prospects of Trump Media and the impact of the additional stock on the company’s valuation.

Analysts and financial experts are divided on the implications of Trump Media’s decision to issue more DJT shares. Some view it as a proactive measure to enhance the company’s liquidity and financial flexibility, enabling it to pursue growth opportunities and strategic initiatives. Others interpret the move as a sign of financial distress or a lack of alternative funding options, leading to dilution of existing shareholders’ ownership and potentially undermining shareholder value in the near term.

The fluctuation in Trump Media’s share prices underscores the inherent volatility and uncertainty in the stock market, where investor sentiment and market dynamics can swiftly influence stock valuations and company performance. The aftermath of the DJT stock issuance filing serves as a reminder of the importance of prudent financial management, transparency, and effective communication with investors to maintain market confidence and sustain long-term value creation.

As Trump Media navigates through this pivotal moment in its corporate trajectory, the company’s leadership faces the challenging task of managing stakeholder expectations, addressing market concerns, and executing its strategic vision amid evolving market conditions and competitive pressures. The ultimate impact of the additional DJT stock issuance on Trump Media’s business prospects and shareholder value remains to be seen, highlighting the complex interplay of financial, strategic, and market forces shaping the company’s future outlook and market performance.

In conclusion, the recent plunge in Trump Media shares following the company’s filing to issue additional DJT stock signifies a significant development in the company’s corporate strategy and financial management. Investors and analysts are closely monitoring the situation to assess the implications of the increased stock issuance on Trump Media’s financial health, market valuation, and long-term growth prospects. The market reaction underscores the importance of transparency, effective communication, and sound financial decision-making in navigating the complexities of the stock market and maximizing shareholder value in an increasingly dynamic and competitive business environment.